Nelson Abbott

| Date Served 6-12 Served By PT Paper Served By Constable, Deputy, Private Investigator or Process Server Constable M. Erickson, 374-8497 |

Nelson

T. Abbott (#6695)

Natali Morris (#10739)

Abbott & Associates, P.C.

3651 N 100 E, Suite 300

Provo, UT 84604

Tel. (801) 373-1112

Fax (801) 852-1961

Attorney

for Plaintiffs

IN

THE THIRD JUDICIAL DISTRICT COURT FOR

SALT LAKE COUNTY, STATE OF UTAH

| SUMMONS | |||

| RICHARD EARP and CHRIS RICCARDI, on Behalf of Themselves and All Others Similarly Situated, | Case No. 080909271 |

||

| Plaintiffs, | Judge: Joseph Fratto | ||

vs. |

|||

MYRON WENTZ, RONALD POELMAN, ROBERT ANCIAUX, JERRY MCCLAIN and USANA HEALTH SCIENCES, INC., |

|||

Defendants. |

|||

THE STATE OF UTAH TO USANA HEALTH SCIENCES, INC., c/o JAMES H. BRAMBLE, REGISTERED AGENT, 3838 W. PARKWAY BLVD, SALT LAKE CITY, UTAH 84120

You are hereby summoned and required to file an answer in writing to the attached Complaint with the Clerk of the above-entitled Court at 450 South State Street, Salt Lake City, Utah 84114 and to serve upon, or mail to Petitioner's attorney, Nelson T. Abbott of Abbott & Associates, P.C., 3651 North 100 East, Ste 300, Provo, Utah 84604, a copy of said Answer, within twenty (20) days after service of this Summons upon you. If you fail so to do, judgment by default will be taken against you for the relief demanded in said Complaint which has been filed with the Clerk of said Court and a copy of which is hereto annexed and herewith served upon you.

DATED this 11th day of June, 2008.

|

||

Nelson Abbott |

Serve

Defendant At:

James H. Bramble

Registered Agent for

USANA Health Sciences, Inc.

3838 W. Parkway Blvd.

Salt Lake City, Utah 84120

1

| [STAMP] |

Nelson

Abbott (#6695)

Natali Morris (#10739)

ABBOTT & ASSOCIATES, P.C.

3651 North 100 East, # 300

Provo, Utah 84604

P. (801) 373-1112

LEVI & KORSINSKY, LLP

Eduard Korsinsky (to be admitted pro hac vice)

Juan E. Monteverde (to be admitted pro hac vice)

39 Broadway, Suite 1601

New York, New York 10006

P. (212) 363-7500

UTAH STATE THIRD DISTRICT COURT

SALT LAKE CITY DISTRICT COURT

| RICHARD EARP and CHRIS RICCARDI, on Behalf of Themselves and All Others Similarly Situated, | ) ) ) ) |

|||||

| ) | Case No. | |||||

| Plaintiff, | ) | |||||

| ) | CIVIL ACTION |

|||||

| vs. | ) | |||||

| ) | CLASS ACTION COMPLAINT | |||||

| MYRON WENTZ, RONALD POELMAN, ROBERT ANCIAUX, JERRY MCCLAIN and USANA HEALTH SCIENCES, INC., | ) ) |

Judge: |

||||

| Defendants. | ||||||

Plaintiffs, by their attorneys, allege upon information and belief, except for their own acts, which are alleged on knowledge, as follows:

Plaintiffs brings this action on behalf of the public stockholders of USANA Health Sciences, Inc. ("USANA" or the "Company") seeking injunctive and other appropriate relief with respect to a proposed transaction in which USANA has announced that Gull Holdings, Ltd. and other participants ("Gull"), plan to acquire all the outstanding shares of USANA through a cash tender offer at the unfair price of $26.00 per share, pursuant to unfair terms, and without adequate disclosure (the "Proposed Transaction"). The Proposed Transaction is valued at $426 million.

PARTIES

1. Plaintiffs are, and have been at all relevant times, the owners of shares of the common stock of USANA.

2. USANA is a corporation organized and existing under the laws of the State of Utah and maintains its principal corporate offices at 3838 West Parkway Boulevard, Salt Lake City, Utah. USANA develops, manufactures, and distributes nutritional and personal care products. USANA sells and distributes its products through independent distributors in the United States, Canada, Mexico, Australia, New Zealand, Hong Kong, Japan, Taiwan, South Korea, and Singapore.

3. Defendant Myron Wentz ("Wentz") has been the Chairman of Board of Directors and Chief Executive of the Company Officer since 1992. Gull is controlled by Wentz and currently controls 68% of the Company's common stock.

4. Defendant Ronald Poelman ("Poelman") has been a Director of the Company since 1995.

5. Defendants Robert Anciaux ("Anciaux") has been a Director of the Company since 1996.

6. Defendant Jerry McClain ("McClain") has been a Director of the Company since 2001.

7. Defendants referenced in ¶¶ 4 through 6 are collectively referred to as Individual Defendants and/or the USANA Board. The Individual Defendants as officers and/or directors of USANA, have a fiduciary relationship with Plaintiffs and the other public shareholders of USANA and owe them the highest obligations of good faith, fair dealing, loyalty and due care.

INDIVIDUAL DEFENDANTS' FIDUCIARY DUTIES

8. By reason of Individual Defendants' positions with the Company as officers and/or Directors, they are in a fiduciary relationship with Plaintiffs and the other public shareholders of USANA and owe them, as well as the Company, a duty of highest good faith, fair dealing, loyalty and full, candid and adequate disclosure, as well as a duty to maximize shareholder value.

9. Where the officers and/or Directors of a publicly traded corporation undertake a transaction that will result in either: (i) a change in corporate control, or (ii) a break up of the corporation's assets, or (iii) sale of the corporation, the Directors have an affirmative fiduciary obligation to obtain the highest value reasonably available for the corporation's shareholders, and if such transaction will result in a change of corporate control, the shareholders are entitled to receive a significant premium. To diligently comply with their fiduciary duties, the Directors and/or officers may not take any action that:

(a) adversely affects the value provided to the corporation's shareholders;

(b) favors themselves or will discourage or inhibit alternative offers to purchase control of the corporation or its assets;

(c) contractually prohibits them from complying with their fiduciary duties;

(d) will otherwise adversely affect their duty to search and secure the best value reasonably available under the circumstances for the corporation's shareholders; and/or

(e) will provide the Directors and/or officers with preferential treatment at the expense of, or separate from, the public shareholders.

10. In accordance with their duties of loyalty and good faith, the Individual Defendants, as Directors and/or officers of USANA, are obligated to refrain from:

(a) participating in any transaction where the Directors or officers' loyalties are divided;

(b) participating in any transaction where the Directors or officers receive, or are entitled to receive, a personal financial benefit not equally shared by the public shareholders of the corporation; and/or

(c) unjustly enriching themselves at the expense or to the detriment of the public shareholders.

11. Plaintiffs allege herein that the Individual Defendants, separately and together, in connection with the Proposed Transaction are knowingly or recklessly violating their fiduciary duties, including their duties of loyalty, good faith and independence owed to Plaintiffs and other public shareholders of USANA, or are aiding and abetting others in violating those duties.

12. Defendants also owe the Company's stockholders a duty of truthfulness, which includes the disclosure of all material facts concerning the Proposed Transaction and, particularly, the fairness of the price offered for the stockholders' equity interest. Defendants are knowingly or recklessly breaching

2

their fiduciary duties of candor and good faith by failing to disclose all material information concerning the Proposed Transaction, and/or aiding and abetting other Defendants' breaches.

13. Defendants are knowingly or recklessly breaching their duties of loyalty, good faith, independence and candor in connection with the Proposed Transaction and have the burden of proving the inherent or entire fairness of the Proposed Transaction, including all aspects of its negotiation, structure, price and terms.

CLASS ACTION ALLEGATIONS

14. Plaintiffs bring this action on their own behalf and as a class action on behalf of all owners of USANA common stock and their successors in interest, except Defendants and their affiliates (the "Class").

15. This action is properly maintainable as a class action for the following reasons:

(a) the Class is so numerous that joinder of all members is impracticable. As of May 20, 2008, USANA had approximately 16.3 million shares outstanding.

(b) questions of law and fact are common to the Class, including, inter alia, the following:

(i) Have the Individual Defendants breached their fiduciary duties owed by them to Plaintiffs and the other members of the Class;

(ii) Are the Individual Defendants, in connection with the Proposed Transaction of USANA by Gull, pursuing a course of conduct that does not maximize USANA's value in violation of their fiduciary duties;

(iii) Have the Individual Defendants mi-srepresented and omitted material facts in violation of their fiduciary duties owed by them to Plaintiffs and the other members of the Class;

(iv) Has Gull aided and abetted the Individual Defendants' breaches of fiduciary duty; and

(v) Is the Class entitled to injunctive relief or damages as a result of Defendants' wrongful conduct.

(c) Plaintiffs are committed to prosecuting this action and have retained competent counsel experienced in litigation of this nature.

(d) Plaintiffs' claims are typical of those of the other members of the Class.

(e) Plaintiffs have no interests that are adverse to the Class.

(f) The prosecution of separate actions by individual members of the Class would create the risk of inconsistent or varying adjudications for individual members of the Class and of establishing incompatible standards of conduct for Defendants.

(g) Conflicting adjudications for individual members of the Class might as a practical matter be dispositive of the interests of the other members not parties to the adjudications or substantially impair or impede their ability to protect their interests.

3

CLAIM FOR RELIEF

16. In a press release dated May 13, 2008, USANA has announced that Gull intends to make an offer to the shareholders of USANA to acquire all of the outstanding shares that Gull and the other participants in the offer do not already own, for cash at a per share offer price of $26.00 in cash.

SALT LAKE CITY—(BUSINESS WIRE)—Gull Holdings, Ltd., today announced its intention to make an offer to the shareholders of USANA Health Sciences, Inc. (Nasdaq:USNA—News) to acquire all of the outstanding shares that Gull Holdings and the other participants in the offer do not already own, for cash at a per share offer price of $26.00. Gull Holdings is controlled by Dr. Myron W. Wentz, Chairman and Chief Executive Officer of USANA. The proposed offer price represents a 24.8-percent premium to the closing price of USANA common stock on May 12, 2008 and a 29.2-percent premium to the volume weighted average price of USANA common stock for the 30-day period ending on May 12, 2008. The offer is proposed to be made through an acquisition vehicle, Unity Acquisition Corp., controlled by Gull Holdings. Gull Holdings and the other participants in the offer currently own or control approximately 68 percent of USANA common stock. The purchase price for the offer is expected to be funded through debt financing, and Gull Holdings has obtained a commitment from a major institutional lender for such financing. Such financing is subject to customary conditions.

"We are pleased to make this offer to shareholders to purchase the remaining shares of USANA at a significant premium," said Dr. Myron W. Wentz. "Our mission is to develop and provide the highest quality, science-based health products, distributed internationally through network marketing. Going private will provide significant cost savings and will allow USANA's talented management team, employees, and Associates to focus solely on providing industry-leading products and building USANA's strong Associate network without the pressures and distractions brought on by the public market. USANA has not relied upon its public company status to raise capital and I do not expect that to change."

Completion of the tender offer will be subject to, among other things, (i) closing of the necessary debt financing to complete the offer, (ii) the holders of at least the majority of the publicly-held shares tendering their shares in the offer, and (iii) the acquisition entity holding at least 90 percent of the outstanding shares of USANA common stock at the completion of the offer, including the shares held by Gull Holdings and the other participants in the offer.

Following successful completion of the tender offer, Gull Holdings will effect a short-form merger of Unity Acquisition Corp. with and into USANA, in which USANA shares held by the remaining public shareholders will be converted into the same consideration paid in the tender offer.

17. On June 5, 2008, Gull formally commenced a tenderofffer for $26 per share in cash.

18. Gull and its affiliates control about 68% of the Company's common stock. Gull is controlled by Defendant Wentz, Chairman and Chief Executive Officer of USANA.

19. The proposed purchase price of $26.00 per share does not represent the true value of the assets and future prospects underlying each share of USANA. The proposed transaction is an attempt by Gull to cash out the minority shareholders in USANA at an unfair price, under unfair terms, and without adequate disclosure.

20. The May 13th press release described a premium of 29.2% to the volume weighted average price of USANA common stock for the prior 30-day period..

21. However, the stated premium of 29.2% is misleading because for more than two year priors to the announcement of the Proposed Transaction, the shares of USANA had been trading at substantially

4

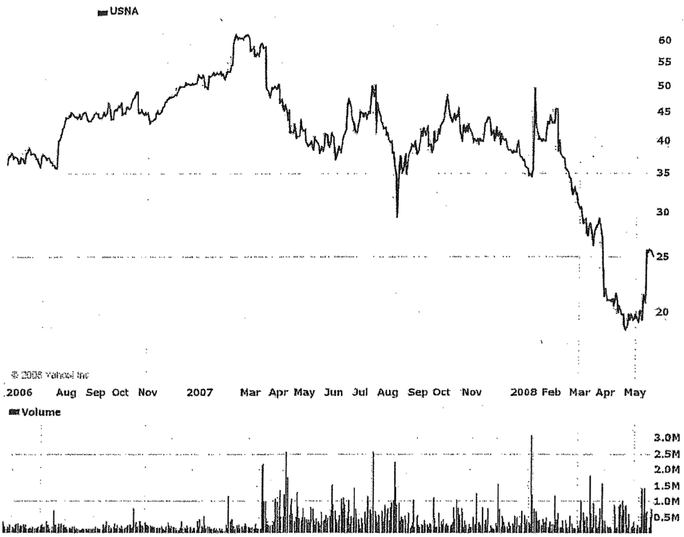

higher prices between $30 and $60 per share. Indeed, as recently as February 2008, the Company's shares had been trading for more than $45 per share. Shown below is a chart of the trading prices for the Company's common stock over the last two years.

22. The graph demonstrates that the Proposed Transaction seeks to capitalize on the temporary decline in the Company's stock price by attempting to purchase the minority shares of the public float at a lowball price.

23. Upon information and belief, the recent decline in the Company's stock price was due to higher operating costs and lower sales in its North American business. In Defendant Wentz's own words, the "first quarter financial results were disappointing... [because] new promotional activities during the first quarter did not increase sales, as we had anticipated." However, it was Defendant Wentz who was in a position to determine what so-called "promotional activities" to employ and the revenue decline was therefore a product of his own decision.

24. With 68% aggregate voting power, Gull has the power to approve the Proposed Transaction without being checked by an independent and disinterested Board of Directors. The Proposed Transaction is an attempt by Gull to cash out the minority shareholders at an unfair price, under unfair terms, through improper means, and with inadequate disclosure. Unless this transaction is enjoined, approval of this grossly unfair transaction is virtually a forgone conclusion and shareholders will have no recourse.

5

COUNT I

Breach of Fiduciary Duty—Failure to Maximize Shareholder Value

25. Plaintiffs repeat all previous allegations as if set forth in full herein.

26. As Directors of USANA, the Individual Defendants stand in a fiduciary relationship to Plaintiffs and the other public stockholders of the Company and owe them the highest fiduciary obligations of loyalty and care. .

27. As a result of the Individual Defendants' breaches of their fiduciary duties, Plaintiffs and the Class will suffer irreparable injury in that they have not and will not receive their fair portion of the value of USANA's assets and will be prevented from benefiting from a value-maximizing transaction.

28. Unless enjoined by this Court, the Individual Defendants will continue to breach their fiduciary duties owed to Plaintiffs and the Class, and may consummate the Proposed Transaction, to the irreparable harm of the Class.

29. Plaintiffs and the Class have no adequate remedy at law.

COUNT II

Breach of Fiduciary Duty—Disclosure

30. Plaintiffs repeat all previous allegations as if set forth in full herein.

31. The fiduciary duties of the Individual Defendants in the circumstances of the Proposed Transaction require them to disclose to Plaintiffs and the Class all information material to the decisions confronting USANA's shareholders.

32. As set forth above, the Individual Defendants have breached their fiduciary duty through materially inadequate disclosures and material omissions.

33. As a result, Plaintiffs and the Class members are being harmed irreparably.

34. Plaintiffs and the Class have no adequate remedy at law.

WHEREFORE, Plaintiffs demand judgment against Defendants jointly and severally, as follows:

(A) declaring this action to be a class action and certifying Plaintiffs as the Class representatives and their counsel as Class counsel;

(B) enjoining, preliminarily and permanently, the Proposed Transaction;

(C) in the event that the transaction is consummated prior to the entry of this Court's final judgment, rescinding it or awarding Plaintiffs and the Class rescissory damages;

(D) directing that Defendants account to Plaintiffs and the other members of the Class for all damages caused by them and account for all profits and any special benefits obtained as a result of their breaches of their fiduciary duties;

(E) awarding Plaintiffs the costs of this action, including a reasonable allowance for the fees and expenses of Plaintiffs attorneys and experts; and

6

(F) granting Plaintiffs and the other members of the Class such further relief as the Court deems just and proper.

DATED

this 6th day of June, 2008

| ABBOTT & ASSOCIATES, P.C. | |

Natali Morris (#10739) |

OF COUNSEL

LEVI & KORSINSKY, LLP

Eduard Korsinsky

Juan E. Monteverde

39 Broadway, Suite 1601

New York, New York 10006

P. (212) 363-7500

Plaintiff's address:

Care

of Abbott & Associates, P.C.

3651 North 100 East, # 300

Provo, Utah 84604

P. (801) 373-1112

7