Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material Pursuant to §240.14a-12 |

|

USANA Health Sciences, Inc. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

||||

3838

West Parkway Boulevard

Salt Lake City, Utah 84120-6336

(801) 954-7100

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 20, 2005

Dear Shareholder:

You are invited to attend the Annual Meeting of Shareholders of USANA Health Sciences, Inc., to be held at the corporate headquarters, 3838 West Parkway Boulevard, Salt Lake City, Utah on Wednesday, April 20, 2005 at 11:00 a.m., Mountain Daylight Time, for the following purposes:

Only USANA shareholders of record at the close of business on March 11, 2005, have the right to receive notice of, and to vote at, the Annual Meeting of Shareholders and any adjournment thereof. A list of shareholders entitled to receive notice and to vote at the meeting will be available for examination by a shareholder for any purpose germane to the meeting during ordinary business hours at the offices of USANA at 3838 West Parkway Boulevard, Salt Lake City, Utah, during the 10 days prior to the meeting.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, YOU ARE REQUESTED TO SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ENCLOSED STAMPED ENVELOPE.

| By Order of the Board of Directors, | ||

|

||

Gilbert A. Fuller Corporate Secretary |

Salt

Lake City, Utah

March 21, 2005

USANA HEALTH SCIENCES, INC.

ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT

2

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 20, 2005

The Board of Directors of USANA Health Sciences, Inc. ("We", "USANA" or the "Company") is soliciting proxies to be used at the 2005 Annual Meeting of Shareholders ("Annual Meeting"). Distribution of this Proxy Statement and proxy form is scheduled to begin March 21, 2005. The mailing address of USANA's principal executive offices is 3838 West Parkway Boulevard, Salt Lake City, Utah 84120-6336. If you attend the Annual Meeting, you may withdraw your prior vote personally on any matters brought properly before the meeting. USANA will pay all expenses of the meeting, including the cost of printing and mailing the proxy statement and other materials and the solicitation process.

Why did I receive this proxy statement? We have sent you the Notice of Annual Meeting of Shareholders and this Proxy Statement and the enclosed proxy or voting instruction card because the USANA Board of Directors is soliciting your proxy to vote at our Annual Meeting on April 20, 2005. The Proxy Statement contains information about matters to be voted on at the Annual Meeting.

Who is entitled to vote? You may vote if you owned common stock as of the close of business on March 11, 2005. On March 11, 2005, there were 19,158,528 shares of our common stock outstanding and entitled to vote at the Annual Meeting.

How many votes do I have? Each share of common stock that you own at the close of business on March 11, 2005 entitles you to one vote.

What am I voting on? You will be voting on proposals to:

How do I vote? You can vote in the following ways:

What if I return my proxy or voting instruction card but do not mark it to show how I am voting? Your shares will be voted according to the instructions you have indicated on your proxy or voting instruction card. You can specify whether your shares should be voted for all, some or none of the nominees for director. You can also specify whether you approve, disapprove or abstain from the other proposals. If no

3

direction is indicated, your shares will be voted FOR the election of all of the nominees for director, FOR the ratification of the selection of Grant Thornton as our independent public accountants and, with respect to any other matter that may properly come before the Annual Meeting, at the discretion of the proxy holders.

May I change my vote after I return my proxy card or voting instruction card? You may revoke your proxy or change your vote at any time before it is exercised in one of three ways:

What does it mean if I receive more than one proxy or voting instruction card? It means that you have multiple accounts at the transfer agent and/or with banks and stockbrokers. Please vote all of your shares by returning all proxy and voting instruction cards you receive.

What constitutes a quorum? A quorum must be present to properly convene the Annual Meeting. The presence, in person or by proxy, of the holders of a majority of the outstanding shares entitled to vote at the Annual Meeting constitutes a quorum. You will be considered part of the quorum if you return a signed and dated proxy or voting instruction card or if you attend the Annual Meeting. Abstentions and broker non-votes are counted as shares present at the meeting for purposes of determining whether a quorum exists but not as shares cast for any proposal. Because abstentions and broker non-votes are not treated as shares cast, they would have no impact on Proposals 1 or 2.

What vote is required in order to approve each proposal? The required vote is as follows:

How will voting on any other business be conducted? We do not know of any business or proposals to be considered at the Annual Meeting other than those described in this Proxy Statement. If any other business is proposed and we decide to allow it to be presented at the Annual Meeting, the proxies received from our shareholders give the proxy holders the authority to vote on the matter according to their best judgment.

Who will count the votes? Investor Communications Services will tabulate the votes received prior to the Annual Meeting. Representatives of USANA will act as the inspectors of election and will tabulate the votes cast at the Annual Meeting.

Who pays to prepare, mail and solicit the proxies? We will pay all of the costs of soliciting proxies. We will ask banks, brokers, and other nominees and fiduciaries to forward the proxy materials to the beneficial owners of our common stock and to obtain the authority of executed proxies. We will reimburse them for their reasonable expenses. In addition to the use of mail, proxies may be solicited by our officers, directors,

4

and other employees by telephone or personal solicitation. We will not pay additional compensation to these individuals.

How do I submit a shareholder proposal for next year's Annual Meeting? Any shareholder who intends to present a proposal at the 2006 Annual Meeting of Shareholders must deliver the proposal to the Corporate Secretary, c/o USANA Health Sciences, Inc., 3838 West Parkway Blvd., Salt Lake City, Utah 84120, not later than December 16, 2005, if the proposal is submitted for inclusion in our proxy materials for that meeting pursuant to Rule 14a-8 under the Securities Exchange Act of 1934.

Who should I call if I have questions? If you have questions about the proposals or the Annual Meeting, you may call Riley Timmer, USANA Investor Relations, at (801) 954-7100. You may also send an e-mail to investor.relations@us.usana.com.

PROPOSAL #1—ELECTION OF DIRECTORS

USANA's Bylaws provide that the shareholders or the Board of Directors shall determine the number of directors from time to time, but that there shall be no less than three. The Board of Directors currently has five members. The Board of Directors has nominated five directors to stand for re-election at the Annual Meeting. Each director elected at the Annual Meeting will hold office until the Annual Meeting in 2006, until a successor is elected and qualified, or until the director resigns, is removed or becomes disqualified. The Board of Directors has no reason to believe that any of the nominees for director will be unwilling or unable to serve if elected. If due to unforeseen circumstances a nominee should become unavailable for election, the Board may either reduce the number of directors or substitute another person for the nominee, in which event your shares will be voted for that other person.

The nominees to the Board of Directors in 2005 are Robert Anciaux, Jerry G. McClain, Ronald S. Poelman, Denis E. Waitley, Ph.D., and Myron W. Wentz, Ph.D. All of these nominees currently serve as members of the Board of Directors. Messrs. Anciaux, McClain, and Poelman are independent directors under the NASDAQ rules. The following information is furnished with respect to these nominees:

Robert Anciaux, 59, has served as a director of USANA since July 1996. Since 1990 he has been the Managing Director of S.E.I. s.a., a consulting and investment management firm in Brussels, Belgium. From 1982 to 1990, Mr. Anciaux was self-employed as a venture capitalist in Europe, investing in various commercial, industrial and real estate venture companies. In some of these privately held companies, Mr. Anciaux also serves as a director. Mr. Anciaux received an Ingenieur Commercial degree from Ecole de Commerce Solvay Universite Libre de Bruxelles.

Jerry G. McClain, 64, has served as a director of USANA since June 2001. From August 2000 until December 2002, Mr. McClain was the Chief Financial Officer of Cerberian, Inc., a privately held company headquartered in Salt Lake City, Utah. From 1998 to 2000, Mr. McClain was the Chief Financial Officer and Sr. Vice President of Assentive Solutions, Inc., a company he also co-founded. From 1997 to 1998, Mr. McClain was the Chief Financial Officer for the Salt Lake Organizing Committee for the 2002 Winter Olympic Games. Before 1997, Mr. McClain served as a key financial advisor to many companies as a Senior Partner of Ernst & Young LLP, where for 35 years he served in several cities throughout the world. Mr. McClain is a CPA and a graduate from the University of Southern Mississippi and Oklahoma State University, where he received a B.S. in Accounting and an M.S. in Accounting, respectively.

Ronald S. Poelman, 51, has served as a director of USANA since 1995. Since 1994, he has been a partner in the Salt Lake City, Utah law firm of Jones, Waldo, Holbrook & McDonough, where he is head of the Business Department. Mr. Poelman began his legal career in Silicon Valley in California,

5

and has assisted in the organization and financing of numerous companies over the past 20 years. Mr. Poelman received a B.A. in English from Brigham Young University and a J.D. from the University of California, Berkeley.

Denis E. Waitley, Ph.D., 71, has served as a director of USANA since May 2000. Dr. Waitley has also served as a consultant to and a spokesperson for USANA since September 1996. Since 1980, Dr. Waitley has been President of the Waitley Institute, a corporate leadership-training firm he founded to provide professional and personal development skills for business executives. Dr. Waitley also serves as President of International Learning Technologies, Inc., a company he founded in 1989 that produces educational audio/visual materials for companies and individuals. During the 1980's, Dr. Waitley served as Chairman of Psychology for the U.S. Olympic Committee's Sports Medicine Council. He is the author of several national best selling non-fiction books and audio programs on personal excellence. Dr. Waitley received a B.S. from the U.S. Naval Academy at Annapolis, an M.A. in Organizational Development from the Naval Post Graduate School in Monterrey, California, and a Ph.D. in Human Behavior from La Jolla University.

Myron W. Wentz, Ph.D., 64, founded USANA in 1992 and has served as the Chief Executive Officer and Chairman of the Board of USANA since its inception. In 1974, Dr. Wentz founded Gull Laboratories, Inc., a developer and manufacturer of medical diagnostic test kits and the former parent of USANA. Dr. Wentz served as Chairman of Gull from 1974 until 1998. In 1998, Dr. Wentz founded Sanoviv, S.A. de C.V. ("Sanoviv"), a health and wellness center located near Rosarito, Mexico. From 1969 to 1973, Dr. Wentz served as Director of Microbiology for Methodist Medical Center, Proctor Community Hospital, and Pekin Memorial Hospital, all of which are located in Peoria, Illinois. Dr. Wentz received a B.S. in Biology from North Central College, Naperville, Illinois, an M.S. in Microbiology from the University of North Dakota, and a Ph.D. in Microbiology and Immunology from the University of Utah.

We will vote your shares as you specify in your proxy. If you sign, date and return your proxy but do not specify how you want your shares voted, we will vote them FOR the election of each of the director nominees listed above.

RECOMMENDATION

The Board of Directors unanimously recommends a vote FOR each director nominee.

The Board of Directors is elected by and accountable to the shareholders of the Company. The Board establishes policy and provides strategic direction, oversight, and control of the Company. The Board met four times in fiscal 2004. All directors attended at least 75% of the meetings of the Board and the Board Committees of which they are members.

We assess director independence on an annual basis. The Board has determined, after careful review, that each member of the Audit Committee is independent, and that three of the five members of the Board of Directors nominated for election are independent under applicable listing standards of NASDAQ.

Shareholder Communications with Directors

The Board of Directors has not established a formal process for shareholders to follow to send communications to the Board or its members, as the Company's policy has been to forward to the directors any shareholder correspondence it receives that is addressed to them. Shareholders who wish

6

to communicate with the directors may do so by sending their correspondence addressed to the director or directors at the Company's headquarters at 3838 West Parkway Blvd., Salt Lake City, Utah 84120-6336.

Directors are encouraged by the Company to attend the Annual Meeting of Shareholders if their schedules permit. All directors except Robert Anciaux were present at the Annual Meeting of the Shareholders held in April 2004.

Committees of the Board of Directors

The Board of Directors has a standing Audit Committee, Compensation Committee, and Governance and Nominating Committee. All members of the Audit Committee, Compensation Committee and Governance and Nominating Committee meet the definition of "independent" set forth in the listing standards of the NASDAQ.

Governance and Nominating Committee. The Governance and Nominating Committee of the Board of Directors ("Nominating Committee") was established in February 2004 and met no times during fiscal 2004. Members of the Nominating Committee during fiscal 2004 and at the date of this Proxy Statement are Robert Anciaux and Ronald S. Poelman, both of whom meet the definition of "independent" set forth in the listing standards of the NASDAQ. A written charter has been adopted for the Nominating Committee and can be accessed electronically in the "Corporate Governance" section which is on the "Investors" page of our website at www.usanahealthsciences.com. The Nominating Committee's responsibilities include: (i) identifying and evaluating prospective nominees for director, (ii) recommending to the Board of Directors the director nominees for the next annual meeting of shareholders, (iii) periodically reviewing the performance of the Board and its members and determining the number, function, and composition of the Board's committees, and (iv) overseeing governance matters.

The Nominating Committee believes that the Company's Board of Directors should be comprised of directors with varied, complementary backgrounds, and that directors should, at a minimum, have expertise that may be useful to the Company. Directors should also possess the highest personal and professional ethics and should be willing and able to devote the required amount of time to Company business. In determining whether a director should be retained and stand for re-election, the Nominating Committee also considers that member's performance and contribution to the Board during his or her tenure with the Board.

The independent directors may from time to time consider qualified nominees recommended by shareholders, who may submit recommendations to the independent directors through a written notice as described under "How do I submit a shareholder proposal for next year's Annual Meeting" on page 4 of this Proxy Statement. Nominees for director who are recommended by shareholders will be evaluated in the same manner as any other nominee for director.

Audit Committee. The Audit Committee of the Board of Directors ("Audit Committee") is a separately designated standing committee of the Board, established pursuant to Section 3(a)(58)(A) of the Securities Exchange Act of 1934. The Audit Committee met four times during fiscal 2004. Members of the Audit Committee during fiscal 2004 and at the date of this Proxy Statement are Ronald S. Poelman, Chairman, Robert Anciaux, and Jerry G. McClain, all of whom meet the definition of "independent" set forth in the listing standards of the NASDAQ. The Board has determined that Mr. McClain is an "audit committee financial expert," as defined by Item 401 under Regulation S-K promulgated by the Securities and Exchange Commission. A written charter has been adopted for the Audit Committee and can be accessed electronically in the "Corporate Governance" section which is on the "Investors" page of our website at www.usanahealthsciences.com, and is attached as Exhibit "A" to the Proxy Statement. We believe that the charter complies with the current requirements of NASDAQ regarding audit committee charters. The Audit Committee's responsibilities

7

include: (i) appointing the independent public accountants of the Company, (ii) reviewing and approving the scope and cost of proposed audit and non-audit services provided by, as well as the qualifications and independence of the independent auditors, (iii) reviewing with the independent auditors and internal audit staff the results of audits, any recommendations from and the status of management's actions for implementing such recommendations, as well as the quality and adequacy of our internal financial controls and internal audit staff, and (iv) reviewing annual and quarterly financial statements and the status of material pending litigation and regulatory proceedings.

Compensation Committee. The Compensation Committee of the Board of Directors ("Compensation Committee") met four times during fiscal 2004. Members of the Compensation Committee during fiscal 2004 and at the date of this Proxy Statement are Robert Anciaux, Chairman, Jerry G. McClain, and Ronald S. Poelman, all of whom meet the definition of "independent" set forth in the listing standards of the NASDAQ. A written charter has been adopted for the Compensation Committee and can be accessed electronically in the "Corporate Governance" section which is on the "Investors" page of our website at www.usanahealthsciences.com. The Compensation Committee's responsibilities include: (i) reviewing and recommending to the full Board of Directors the salaries, bonuses, and other forms of compensation and benefit plans for management, and (ii) administering USANA's stock option plans. Among other things, the duties of the Compensation Committee as the administrator of the plan include, but are not limited to, determining those persons who are eligible to receive awards, establishing terms of all awards, authorizing officers of the Company to execute grants of awards, and interpreting the provisions of the Plan and grants made under the Plan.

Each director who is not an employee of the Company receives an annual retainer of $5,000. We also reimburse all directors for their out-of-pocket expenses incurred in connection with their service as directors, which include travel, lodging, and related expenses from attending or participating in meetings of the shareholders, Board of Directors, and committees of the Board.

In July 2002, the Board of Directors adopted, and the stockholders approved, the 2002 Stock Option Plan. Each director was granted options based upon his time spent serving on the Board. With the adoption of the 2002 Stock Option Plan, the Board determined that no new awards would be granted under the prior plans. In addition, certain director options were cancelled during 2002 with the adoption of the 2002 Stock Option Plan. The Compensation Committee of the Board of Directors administers the stock option plans of the Company.

Our Bylaws provide that individuals serving as directors or officers of the Company will not incur personal liability for actions taken during their service and that the Company will indemnify its directors and officers to the fullest extent authorized by Utah law. The Company has purchased insurance against obligations it might incur as a result of its indemnification of officers and directors for certain liabilities they might incur and insuring such officers and directors for additional liabilities against which they might not be indemnified by USANA. The policy also provides insurance for our own liabilities in certain circumstances. The cost of the insurance premiums covering the 12-month insurance period ending November 20, 2005 is approximately $313,000.

PROPOSAL #2—RATIFICATION OF SELECTION OF INDEPENDENT PUBLIC ACCOUNTANTS

The Audit Committee of the Board of Directors has selected Grant Thornton LLP as the independent public accountants to audit the financial statements of the Company and its subsidiaries for the fiscal year ending December 31, 2005. Grant Thornton has served as the Company's independent public accountants since the fiscal year ended December 31, 1995 and audited the financial statements of the Company for the years ended January 1, 2005 and January 3, 2004. While ratification of the selection of accountants by the shareholders is not required and is not binding upon

8

the Audit Committee or the Company, in the event of a negative vote on such ratification, the Audit Committee might choose to reconsider its selection.

Grant Thornton has advised us that it has no direct or indirect financial interest in the Company or any of its subsidiaries, and that it has had, during the last three years, no connection with the Company or any of its subsidiaries other than as independent auditors, or in connection with certain other activities as described below.

Financial Statements and Reports

The financial statements of the Company for the year ended January 1, 2005, and report of the independent auditors will be presented at the Annual Meeting. Grant Thornton will have a representative present at the meeting who will have an opportunity to make a statement if he or she so desires and to respond to appropriate questions from shareholders.

During fiscal years 2004 and 2003, Grant Thornton provided services consisting of the audit of the annual consolidated financial statements of the Company, review of the quarterly financial statements, stand-alone audits of subsidiaries, accounting consultations and consents and other services related to SEC filings and registration statements filed by the Company and its subsidiaries and other pertinent matters. Grant Thornton also provided other services to the Company in fiscal years 2004 and 2003, consisting primarily of tax consultation and related services. Grant Thornton did not perform any financial information systems design and implementation services for the Company for the fiscal years 2004 and 2003.

The Audit Committee has considered whether the provision of non-audit services is compatible with maintaining Grant Thornton's independence. Prior to the performance of any services, the Audit Committee approves all audit and non-audit related services to be provided by the Company's independent auditor and the fees to be paid therefore. Although the Sarbanes-Oxley Act of 2002 permits the Audit Committee to pre-approve some types or categories of services to be provided by the auditors, it is the current practice of the Audit Committee to specifically approve all services provided by the auditors in advance, rather than to pre-approve, generally, any type of service.

The following table summarizes the fees paid to Grant Thornton during fiscal years 2004 and 2003.

| Type of Service and Fee |

Fiscal 2004 |

Fiscal 2003 |

||||

|---|---|---|---|---|---|---|

| Audit Fees | $ | 588,462 | $ | 179,244 | ||

| Audit Related Fees | 20,773 | 25,421 | ||||

| Tax Fees | 38,037 | 153,376 | ||||

| All Other Fees | 110,054 | — | ||||

| Total Fees | $ | 757,326 | $ | 358,041 | ||

RECOMMENDATION

The Board of Directors unanimously recommends a vote FOR ratification of the appointment of Grant Thornton LLP as the Company's independent public accountants.

9

[The following report of the Audit Committee shall not be deemed incorporated by reference by any general statement incorporating this Proxy Statement into any other filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent USANA specifically incorporates this information by reference, and shall not otherwise be deemed filed under those acts.]

The Audit Committee oversees the Company's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. The directors who serve on the Audit Committee are all independent for purposes of Rule 4200(A)(15) of The NASDAQ Marketplace Rules.

The Audit Committee operates under a written charter adopted by the Board of Directors.

We have reviewed and discussed with management the Company's audited financial statements as of and for the year ended January 1, 2005.

We have discussed with the independent public accountants of the Company, Grant Thornton LLP, the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants, which includes a review of the findings of the independent accountants during its examination of the Company's financial statements.

We have received and reviewed written disclosures and the letter from Grant Thornton, required by Independence Standard No. 1, Independence Discussions with Audit Committee, as amended, by the Independence Standards Board, and we have discussed with Grant Thornton their independence under such standards. We have concluded that the independent public accountants are independent from the Company and its management.

Based on our review and discussions referred to above, we have recommended to the Board of Directors (and the Board has approved our recommendation) that the audited financial statements of the Company be included in the Company's Annual Report on Form 10-K for the year ended January 1, 2005 for filing with the Securities and Exchange Commission.

Respectfully submitted by the members of the Audit Committee:

| Ronald S. Poelman (Chairman) Robert Anciaux Jerry G. McClain |

10

The executive officers of USANA at January 1, 2005, and as of the date of this Proxy Statement, were:

| Name |

Position |

|

|---|---|---|

| Myron W. Wentz, Ph.D. | Chairman of the Board and Chief Executive Officer | |

| David A. Wentz | President | |

| Gilbert A. Fuller | Senior Vice President, Chief Financial Officer, and Secretary | |

| Fred W. Cooper, Ph.D. | Vice President of Operations | |

| Mark H. Wilson | Vice President of Customer Relations | |

| Timothy E. Wood, Ph.D. | Vice President of Research and Development |

Biographical information for Myron W. Wentz is included in the discussion on page 6 concerning the nominees for director. The following information is provided regarding David A. Wentz, and Messrs. Fuller, Cooper, Wilson, and Wood.

David A. Wentz, 34, President. Mr. Wentz joined USANA as a part-time employee in 1992. He has been a full-time employee since March 1994. From 1993 until April 2004 he was a member of the Company's Board of Directors. Mr. Wentz was appointed President of USANA in July 2002, previously serving as Executive Vice President from October 2001 to July 2002. He served as the Senior Vice President of Strategic Development from June 1999 to October 2001 and as the Vice President of Strategic Development from August 1996 to June 1999. Mr. Wentz received a B.S. degree in Bioengineering from the University of California, San Diego. Mr. Wentz is the son of Dr. Wentz, the Chairman and Chief Executive Officer of the Company.

Gilbert A. Fuller, 64, Senior Vice President, Chief Financial Officer, and Secretary. Mr. Fuller joined USANA in May 1996 as the Vice President of Finance. Mr. Fuller served in this role from May 1996 to June 1999, when he was appointed Senior Vice President. Mr. Fuller has been Chief Financial Officer since October 1997. Before joining USANA, from January 1994 to May 1996, Mr. Fuller was the Executive Vice President of Winder Dairy, Inc., a regional commercial dairy operation. From May 1991 through October 1993, Mr. Fuller was Chief Administrative Officer and Treasurer of Melaleuca, Inc., a manufacturer and network marketer of personal care products. From July 1984 through January 1991, Mr. Fuller was the Vice President and Treasurer of Norton Company, a multinational manufacturer of ceramics and abrasives. Mr. Fuller is a Certified Public Accountant and received a B.S. in Accounting and an M.B.A. from the University of Utah.

Fred W. Cooper, Ph.D., 42, Vice President of Operations. Dr. Cooper was a consultant to the Company from 1997 until early 1998. In February 1998 he joined the Company on a part-time basis as Director of Special Projects. From April 1998 until April 1999 he was employed as a full-time employee in the capacity of Executive Director of Information Technology and from April 1999 until August 2000, with the title of Vice President of Information Technology. From August 2000 until July 2003, Dr. Cooper was employed by the Company on a part-time basis as Vice President of Information Technology. He was again brought on as a full time employee in July 2003 as Vice President of Operations. Prior to joining USANA, from April 1994 to February 1998, Dr. Cooper was the Director of Market Research and then later promoted to Director of Corporate Network Operations for Human Affairs International, a subsidiary of Aetna. Dr. Cooper received a B.S. in Finance and a B.S. in Psychology from the University of Utah. He earned a Ph.D. in Business Administration from the University of Utah.

Mark H. Wilson, 40, Vice President of Customer Relations. Mr. Wilson joined USANA in October 1996 as Director of Customer Relations. Mr. Wilson served as Executive Director of Customer Relations from 1998 to April 2000. Since April 2000, he has served as the Vice President of Customer

11

Relations. Prior to joining USANA, from October 1994 to October 1996, Mr. Wilson was owner/partner of Great Basin Marketing, a consulting company specializing in call center start-up and operational management. Prior to joining Great Basin Marketing, from July 1991 until October 1994, Mr. Wilson was Director of Inbound Order Express and Data Processing for Melaleuca, Inc. Mr. Wilson holds a B.S. in Communications from the University of Utah.

Timothy E. Wood, Ph.D., 56, Vice President of Research and Development. Dr. Wood joined USANA in June 1996 as Director of Research and Development. Dr. Wood served in this role from June 1996 to June 1999, when he was appointed Vice President of Research and Development. Before joining USANA, Dr. Wood served as Vice President of Research and Development for AgriDyne Technologies, Inc., formerly known as NPI, from 1992 to 1995, where he managed a team of 25 scientists. From 1980 to 1992, Dr. Wood served as Research Manager and Senior Scientist for AgriDyne Technologies. Dr. Wood received a B.S. in Environmental Biology from the University of California, Santa Barbara. He earned an M.S. in Environmental Sciences and a Ph.D. in Biology from Yale University.

The following table sets forth certain information regarding the beneficial ownership of our common stock as of February 25, 2005 by (1) each person known to be the beneficial owner of more than 5% of the issued and outstanding common stock, (2) the executive officers and directors of USANA individually, and (3) the executive officers and directors as a group. Except as indicated in the footnotes below, each of the persons listed is believed to exercise sole voting and investment power over the shares of common stock listed for such individual or entity in the table. Unless otherwise

12

indicated, the mailing address of the shareholder is the address of USANA, 3838 West Parkway Blvd., Salt Lake City, Utah 84120.

| Name and Address |

Number of Shares(1) |

Percent of Class(2) |

||||

|---|---|---|---|---|---|---|

| Beneficial Owners of More Than 5% | ||||||

| Gull Holdings, Ltd. 4 Finch Road Douglas, Isle of Man |

8,256,444 | 43.1 | % | |||

Directors and Executive Officers |

||||||

| Myron W. Wentz, Ph.D.(3) Chairman of the Board and CEO |

8,256,444 | 43.1 | % | |||

| David A. Wentz, President(4) | 361,777 | 1.9 | % | |||

| Gilbert A. Fuller(5) Senior Vice President and CFO |

8,804 | * | ||||

| Fred W. Cooper, Ph.D.(6) Vice President of Operations |

23,479 | * | ||||

| Mark H. Wilson(7) Vice President of Customer Relations |

5,895 | * | ||||

| Timothy E. Wood, Ph.D. Vice President of Research and Development |

— | * | ||||

| Robert Anciaux, Director | — | * | ||||

| Jerry G. McClain, Director(8) | 5,200 | * | ||||

| Ronald S. Poelman, Director(9) | 13,000 | * | ||||

| Denis E. Waitley, Ph.D., Director(10) | 70,000 | * | ||||

| Directors and Officers as a group (10 persons) | 8,744,599 | 45.6 | % | |||

13

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee during fiscal 2004 was composed of Robert Anciaux, Chairman, Jerry G. McClain, and Ronald S. Poelman. All members of the Compensation Committee are independent directors. No member of the Company's Compensation Committee is a current or former officer or employee of the Company or any of its subsidiaries, and no director or executive officer is a director or executive officer of any other corporation that has a director or executive officer who is also a director of the Company.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

[The following report of the Compensation Committee shall not be deemed incorporated by reference by any general statement incorporating this Proxy Statement into any other filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent USANA specifically incorporates this information by reference, and shall not otherwise be deemed filed under those acts.]

The Compensation Committee administers the Company's executive compensation program and establishes the salaries of the Company's executive officers. The Compensation Committee consists only of non-employee directors, who are appointed by the Board.

The primary responsibility of the Compensation Committee is to establish executive compensation at levels that will achieve the following objectives:

The components of compensation paid to executive officers consist of: (a) base salary, (b) incentive compensation in the form of stock options awarded under the 1998 and 2002 Stock Option Plans, and (c) certain other benefits. In 1998, the Committee adopted a cash bonus program as an additional component of executive compensation. A similar bonus program was adopted in each subsequent fiscal year.

The primary components of compensation paid to executive officers and senior management personnel, and the relationship of these components of compensation to the Company's performance, are discussed below:

14

salaries are determined based upon a number of factors, including the Company's performance (to the extent such performance can fairly be attributed or related to each executive's performance), as well as the nature of each executive's responsibilities, capabilities and contributions. In addition, the Compensation Committee periodically reviews the base salaries of senior management personnel in an attempt to ascertain whether those salaries fairly reflect job responsibilities and prevailing market conditions and rates of pay. The Compensation Committee believes that base salaries for the Company's executive officers have historically been reasonable, when considered together with other elements of compensation (such as stock options and the bonus plans) in relation to its size and performance and in comparison with the compensation paid by similarly sized companies or companies within the industry.

Compensation of the Chief Executive Officer

The Company's Founder and Chairman, Dr. Myron W. Wentz, has also served with the title of Chief Executive Officer of USANA since its inception. Dr. Wentz does not receive any compensation for his services and he has in the past declined to accept any options or other awards under any stock option or stock incentive plan that he might otherwise have been entitled to receive as an executive officer.

Internal Revenue Code Section 162(m)

The Compensation Committee also considers the potential impact of Section 162(m) of the Internal Revenue Code of 1986, as amended ("Section 162(m)"). Section 162(m) disallows a tax deduction for any publicly held corporation for individual compensation exceeding $1 million in any taxable year for the Chief Executive Officer and the other senior executive officers, other than compensation that is performance-based under a plan that is approved by the shareholders of the corporation and that meets certain other technical requirements. Based on these requirements, the Compensation Committee has determined that Section 162(m) will not prevent the Company from receiving a tax deduction for any of the compensation paid to executive officers.

Respectfully submitted by the members of the Compensation Committee:

| Ronald S. Poelman (Chairman) Robert Anciaux Jerry G. McClain |

15

COMPENSATION OF EXECUTIVE OFFICERS

The following table sets forth the annual and long-term compensation for services rendered in all capacities to the Company for the last three fiscal years of (1) the Chief Executive Officer and (2) the four most highly compensated executive officers of the Company as of the end of the most recent fiscal year whose total annual salary and bonus exceeds $100,000 ("Named Executive Officers").

| |

|

Annual Compensation |

|

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Position During 2004 |

Year |

Salary |

Bonus |

Other Annual Compensation(1) |

Long-Term Compensation Securities Underlying Options(2) |

All Other Compensation(3) |

||||||||||

| Myron W. Wentz, PhD(4) Chairman and CEO |

2004 2003 2002 |

— — — |

— — — |

— — — |

0 0 0 |

— — — |

||||||||||

David A. Wentz President |

2004 2003 2002 |

$ $ $ |

149,922 149,168 144,498 |

$ $ $ |

37,705 29,567 69,114 |

(5) (6) (7) |

$ $ |

1,883,800 602,150 — |

0 0 300,000 |

$ $ $ |

2,445 2,420 7,885 |

|||||

Gilbert A. Fuller Senior Vice President and Chief Financial Officer |

2004 2003 2002 |

$ $ $ |

173,532 168,318 167,860 |

$ $ $ |

43,643 33,793 80,036 |

(5) (6) (7) |

$ $ $ |

1,279,885 1,237,050 555,600 |

0 0 340,000 |

$ $ $ |

6,256 7,000 6,725 |

|||||

Fred W. Cooper(8) Vice President of Operations |

2004 2003 2002 |

$ $ $ |

137,534 103,910 72,573 |

$ $ $ |

34,590 26,595 61,984 |

(5) (6) (7) |

$ $ $ |

1,099,699 1,092,606 256,000 |

0 0 260,000 |

$ $ $ |

4,378 5,051 2,153 |

|||||

Mark H. Wilson Vice President of Customer Relations |

2004 2003 2002 |

$ $ $ |

137,534 128,391 118,150 |

$ $ $ |

34,590 25,597 56,960 |

(5) (6) (7) |

$ $ $ |

1,330,335 1,308,154 408,100 |

0 0 300,000 |

$ $ $ |

4,899 5,065 3,608 |

|||||

Timothy E. Wood Vice President of Research and Development |

2004 2003 2002 |

$ $ $ |

137,534 129,073 118,679 |

$ $ $ |

34,590 25,724 56,751 |

(5) (6) (7) |

$ $ $ |

1,189,460 1,185,157 279,975 |

0 0 310,000 |

$ $ $ |

4,432 4,001 3,344 |

|||||

16

OPTION GRANTS IN LAST FISCAL YEAR

There were no option grants to the Named Executive Officers during the fiscal year ended January 1, 2005.

OPTION EXERCISES AND FISCAL YEAR-END OPTION VALUE

The following table sets forth information with respect to the exercise of stock options by the Named Executive Officers during the year ended January 1, 2005, as well as the aggregate number and value of unexercised options held by all Named Executive Officers at January 1, 2005. In accordance with Securities and Exchange Commission rules, the value of unexercised options is calculated by subtracting the exercise price from $34.20, the closing price of the common stock as reported on The NASDAQ National Market System on December 31, 2004.

Aggregated Option Exercises in Last Fiscal Year

And Fiscal Year-End Option Values

| Name |

Shares Acquired on Exercise |

Value Realized |

Number of Securities Underlying Unexercised Options at 1/1/2005 Exercisable/Unexercisable |

Value of Unexercised In-the- Money Options at 1/1/2005 Exercisable/Unexercisable |

|||||

|---|---|---|---|---|---|---|---|---|---|

| David A. Wentz | 130,000 | $ | 3,294,050 | 90,000/110,000 | $2,943,450/$3,664,050 | ||||

| Gilbert A. Fuller | 50,000 | $ | 1,501,400 | 0/130,000 | $0/$4,322,550 | ||||

| Fred W. Cooper | 55,000 | $ | 1,637,664 | 0/130,000 | $0/$4,322,550 | ||||

| Mark H. Wilson | 50,000 | $ | 1,488,560 | 0/130,000 | $0/$4,322,550 | ||||

| Timothy E. Wood, Ph.D. | 40,000 | $ | 1,189,460 | 15,000/130,000 | $500,625/$4,322,550 | ||||

EMPLOYMENT CONTRACTS AND OTHER ARRANGEMENTS

The Company has no employment agreements with any of the Named Executive Officers.

The Company maintains the 1998 Stock Option Plan ("1998 Plan") approved by shareholders under which options and other nonstatutory awards were granted to employees, officers, directors and consultants of the Company. The Compensation Committee of the Board of Directors now administers the plan. The total number of shares of common stock reserved for issuance under the 1998 Plan was 8,000,000 shares. As of January 1, 2005, options for the purchase of 171,546 shares remained issuable upon outstanding options under the 1998 Plan.

In 2002, the Company adopted and the shareholders approved the 2002 USANA Health Sciences, Inc. Stock Plan ("2002 Plan"), under which nonstatutory and statutory awards have been granted to employees, officers and directors. With the adoption of the 2002 Plan, the Board of Directors determined that no further awards would be granted under the 1998 Plan. The total number of shares of common stock that may be issued upon exercise of awards granted under the 2002 Plan is 7,000,000 shares. As of January 1, 2005, a total of 3,319,000 shares were available for issuance under options to be granted under the 2002 Plan and 1,760,000 shares were issuable under outstanding options granted previously under the 2002 Plan.

The following table sets forth information as of January 1, 2005, with respect to shares of common stock to be issued upon the exercise, and the weighted-average exercise price, of all outstanding options

17

and rights granted under our equity compensation plans, as well as the number of shares available for future issuance under those plans.

| Plan Category(1) |

Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans |

||||

|---|---|---|---|---|---|---|---|

| 2002 Stock Option Plan | 1,760,000 | $ | 10.02 | 3,319,000 | |||

| 1998 Stock Option Plan | 171,546 | $ | 2.47 | 0 | |||

| Total | 1,931,546 | $ | 9.35 | 3,319,000 | |||

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

Section 16(a) of the Securities Exchange Act of 1934 requires USANA's officers and directors, and persons who beneficially own more than 10% of our common stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission and with NASDAQ. Officers, directors, and greater-than-ten-percent shareholders are also required by regulation of the Securities and Exchange Commission to furnish us with copies of all Section 16(a) forms that they file.

Based solely upon a review of the forms furnished to the Company, and representations made by certain persons subject to this obligation that such filing were not required to be made, the Company believes that all reports required by these individuals and persons under Section 16(a) were filed on time in fiscal year 2004.

18

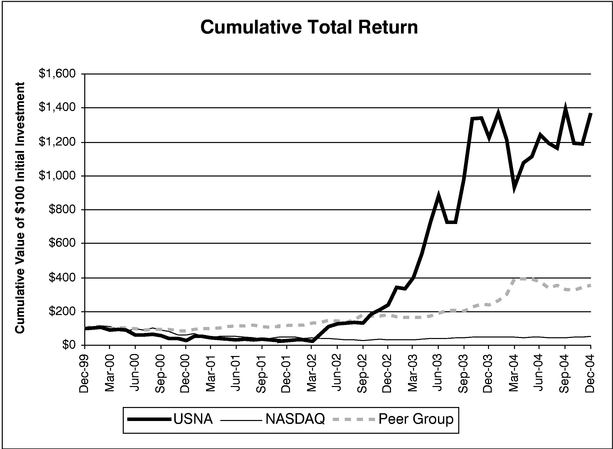

The following graph compares the yearly cumulative total returns on our common stock, the Total Return Index for the NASDAQ Stock Market, and ten companies selected in good faith by USANA from its industry (the "Peer Group") for the last five years. Each of the companies included in the Peer Group markets or manufactures products similar to USANA's products or markets its products through a similar marketing channel. Each company listed was included in the Peer Group in each of the last five years except NuSkin, which was added to the Peer Group for the first time in the Company's 2002 proxy statement. The Peer Group comprises the following companies: NBTY, Inc. (NYSE: NTY), Nature's Sunshine Products, Inc. (NASDAQ: NATR), Avon Products, Inc. (NYSE: AVP), NuSkin Enterprises, Inc. (NYSE: NUS), Natural Alternatives International, Inc. (NASDAQ: NAII), Perrigo Company (NASDAQ: PRGO), Reliv International, Inc. (NASDAQ: RELV), Hain Celestial Group (NASDAQ: HAIN), Lifeway Foods, Inc. (NASDAQ: LWAY) and Chattem, Inc. (NASDAQ: CHTT).

USANA's shares commenced trading in May 1993. The graph assumes an investment on December 30, 1999, of $100 and reinvestment of all dividends into additional shares of the same class of equity, if applicable to the stock or index. This graph is included in accordance with SEC requirements. You are cautioned not to draw any conclusions from this information, as past results are not necessarily indicative of future performance. This graph in no way reflects a forecast of future financial performance or value.

19

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Denis E. Waitley, Ph.D., a director of the Company, has served as a consultant to and spokesperson for the Company since September 1996. During 2004, the Company paid Dr. Waitley consulting fees and royalties totaling $150,000. The consulting contract with Dr. Waitley pays him $150,000 per year and expires in September 2005.

The Audit Committee of the Board of Directors has reviewed and approved the transaction described above.

As of the date of this Proxy Statement, the Board of Directors does not intend to present and has not been informed that any other person intends to present any matter for action at the Annual Meeting other than as set forth herein and in the Notice of Annual Meeting. If any other matter properly comes before the meeting, it is intended that the holders of proxies will act in accordance with their best judgment.

The accompanying proxy is solicited on behalf of the Board of Directors. In addition to the solicitation of proxies by mail, certain of the officers and employees of the Company, without extra compensation, may solicit proxies personally or by telephone, and, if deemed necessary, third party solicitation agents may be engaged by the Company to solicit proxies by means of telephone, facsimile or telegram, although no such third party has been engaged by the Company as of the date hereof.

We will mail a copy of the Company's Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, to each shareholder of record at March 11, 2005. The report on Form 10-K is not deemed a part of the proxy soliciting material.

Additional copies of the Annual Report on Form 10-K for the year ended January 1, 2005 (including financial statements and financial statement schedules) filed with the Securities and Exchange Commission may be obtained without charge by writing to USANA, Attention: Investor Relations, 3838 West Parkway Blvd., Salt Lake City, Utah 84120-6336. The reports and other filings of USANA, including this Proxy Statement, also may be obtained from the SEC's on-line database, located at www.sec.gov.

| By Order of the Board of Directors, | ||

|

||

| Gilbert A. Fuller Corporate Secretary |

||

Date: March 21, 2005 |

20

AUDIT COMMITTEE CHARTER

Of the Board of Directors

USANA HEALTH SCIENCES, INC.

Purpose and Statement of Policy

The Board of Directors hereby adopts this Charter establishing and governing the activities of the Audit Committee of the Board of Directors of USANA Health Sciences, Inc. (the "Audit Committee"). The primary function of the Audit Committee is to provide assistance to the directors of the corporation in fulfilling their responsibility to the shareholders, potential shareholders and investment community relating to accounting, reporting practices and the quality and integrity of the financial reports of the corporation. In so doing, it is the responsibility of the Audit Committee to maintain free and open means of communication between the directors, the independent auditors, and the financial management of the corporation. This Charter may be amended from time to time by the Board of Directors.

Organization

There shall be a committee of the Board of Directors to be known as the Audit Committee. The Audit Committee shall be elected by the Board of Directors and shall be composed of at least three (3) directors who are "independent" as that term is defined by Section 10A3(b)(1) of the Securities Exchange Act of 1934, as amended. Each member of the Audit Committee shall be free from any relationship that, in the opinion of the Board of Directors, would interfere with his or her exercise of independent judgment as a committee member and must otherwise meet the "independence" requirements under Rule 4200(a)(15) of the NASDAQ Stock Market ("NASDAQ"). No member of the Committee shall have participated in the preparation of the financial statements of the Company or of any subsidiary at any time during the past three years. All members of the Audit Committee shall have a working familiarity with basic finance and accounting practices and at least one member of the Audit Committee shall have accounting or related financial management expertise in accordance with NASDAQ Rule 4350(d)(2)(A). No member of the Audit Committee may, other than in his or her capacity as a member of the Audit Committee, the Board of Directors or any other committee of the Board of Directors, (1) accept any consulting, advisory or other compensatory fee from the corporation, or (2) be an affiliate of the corporation or any of its subsidiaries. One member of the Audit Committee will be elected by a majority of the Committee or appointed by the Board of Directors to serve as Chair of the Audit Committee.

Meetings

The Audit Committee shall meet at least four times annually, or more frequently as circumstances dictate. Members of the Audit Committee may participate in meetings of the Committee by attending in person or telephonically. The meetings of the Audit Committee shall include the following:

A-1

independent accountants outside the presence of management, and the Chair of the Audit Committee may represent the entire Committee for purposes of these meetings); (b) the Chief Executive Officer of the corporation; (c) the President of the Corporation; and (d) the Chief Financial Officer of the corporation or, in the absence of the Chief Financial Officer, with the principal accounting officer of the corporation.

Responsibilities and Duties

In carrying out its responsibilities, the Audit Committee believes its policies and procedures should remain flexible, in order to best react to changing conditions and to ensure to the directors and shareholders that the corporate accounting and reporting practices of the corporation are in accordance with all requirements.

In carrying out these responsibilities, the Audit Committee has adopted the following policies and rules.

A-2

Further, the committee periodically should review the corporation's policy statements to determine their adherence to the code of business ethics.

A-3

attend a meeting of the full Board of Directors to assist in reporting the results of the annual audit or to answer other directors' questions (or alternatively, the other directors, particularly the other independent directors, may be invited to attend the Committee meeting during which the results of the annual audit are reviewed).

A-4

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The shareholder executing and delivering this Proxy hereby appoints Dr. Myron W. Wentz, Ph.D. and Gilbert A. Fuller and each of them as Proxies, with full power of substitution, and hereby authorizes them to represent and vote, as designated below, all shares of common stock of the Company held of record by the undersigned as of March 11, 2005, at the Annual Meeting of Shareholders of USANA Health Sciences, Inc., to be held at the Corporate headquarters, 3838 West Parkway Blvd., Salt Lake City, Utah 84120, on Wednesday, April 20, 2005, at 11:00 a.m., Mountain Daylight Time or at any adjournment thereof.

The Board of Directors recommends a Vote "FOR" Items 1 and 2.

| 1. | To elect five directors to serve for one year each, until the next Annual Meeting of Shareholders and until a successor is elected and shall qualify. The nominees are: | |||||||

Myron W. Wentz, Ph.D. |

Ronald S. Poelman |

|||||||

| Robert Anciaux | Denis E. Waitley, Ph.D. | Jerry G. McClain | ||||||

| FOR ALL o |

WITHHOLD AS TO ALL o |

FOR ALL EXCEPT o |

||||||

2. |

To approve and ratify the selection of Grant Thornton LLP as the Company's independent public accountants. |

|||||||

FOR o |

AGAINST o |

ABSTAIN o |

||||||

3. |

To consider and act upon any other matters that properly may come before the meeting or at any postponement or adjournment thereof. |

|||||||

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR PROPOSALS 1 AND 2.

PLEASE SIGN EXACTLY AS THE SHARES ARE ISSUED. WHEN CO-TENANTS HOLD SHARES, BOTH SHOULD SIGN. WHEN SIGNING AS ATTORNEY, AS EXECUTOR, ADMINISTRATOR, TRUSTEE OR GUARDIAN, PLEASE GIVE FULL TITLE AS SUCH. IF A CORPORATION, PLEASE SIGN IN FULL CORPORATE NAME BY PRESIDENT OR OTHER AUTHORIZED OFFICER. IF A PARTNERSHIP, PLEASE SIGN IN PARTNERSHIP NAME BY AUTHORIZED PERSON. PLEASE DATE, SIGN AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

| DATE: | |||||

Signature |

|||||

Signature (Joint Owners) |