Use these links to rapidly review the document

TABLE OF CONTENTS

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material Pursuant to §240.14a-12 |

|

USANA Health Sciences, Inc. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý |

No fee required |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

3838

West Parkway Boulevard

Salt Lake City, Utah 84120-6336

(801) 954-7100

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 21, 2004

Dear Shareholder:

You are invited to attend the Annual Meeting of Shareholders of USANA Health Sciences, Inc., to be held at the corporate headquarters, 3838 West Parkway Boulevard, Salt Lake City, Utah on Wednesday, April 21, 2004 at 11:00 a.m., Mountain Daylight Time, for the following purposes:

Only USANA shareholders of record at the close of business on March 12, 2004, have the right to receive notice of, and to vote at, the Annual Meeting of Shareholders and any adjournment thereof. A list of shareholders entitled to receive notice and to vote at the meeting will be available for examination by a shareholder for any purpose germane to the meeting during ordinary business hours at the offices of USANA at 3838 West Parkway Boulevard, Salt Lake City, Utah, during the 10 days prior to the meeting.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, YOU ARE REQUESTED TO SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ENCLOSED STAMPED ENVELOPE.

| By Order of the Board of Directors, | ||

/s/ GILBERT A. FULLER Gilbert A. Fuller, Corporate Secretary |

Salt

Lake City, Utah

March 19, 2004

USANA HEALTH SCIENCES, INC.

ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT

2

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 21, 2004

The Board of Directors of USANA Health Sciences, Inc. ("USANA" or the "Company") is soliciting proxies to be used at the 2004 Annual Meeting of Shareholders ("Annual Meeting"). Distribution of this Proxy Statement and proxy form is scheduled to begin March 19, 2004. The mailing address of USANA's principal executive offices is 3838 West Parkway Boulevard, Salt Lake City, Utah 84120-6336. If you attend the Annual Meeting, you may withdraw your prior vote personally on any matters brought properly before the meeting. USANA will pay all expenses of the meeting, including the cost of printing and mailing the proxy statement and other materials and the solicitation process.

Why did I receive this proxy statement? We have sent you the Notice of Annual Meeting of Shareholders and this Proxy Statement and the enclosed proxy or voting instruction card because the USANA Board of Directors is soliciting your proxy to vote at our Annual Meeting on April 21, 2004. The Proxy Statement contains information about matters to be voted on at the Annual Meeting.

Who is entitled to vote? You may vote if you owned common stock as of the close of business on March 12, 2004. On March 12, 2004, there were 19,296,674 shares of our common stock outstanding and entitled to vote at the Annual Meeting.

How many votes do I have? Each share of common stock that you own at the close of business on March 12, 2004 entitles you to one vote.

What am I voting on? You will be voting on proposals to:

How do I vote? You can vote in the following ways:

What if I return my proxy or voting instruction card but do not mark it to show how I am voting? Your shares will be voted according to the instructions you have indicated on your proxy or voting instruction

3

card. You can specify whether your shares should be voted for all, some or none of the nominees for director. You can also specify whether you approve, disapprove or abstain from the other proposals. If no direction is indicated, your shares will be voted FOR the election of the nominees for director, FOR the ratification of the selection of Grant Thornton as our independent public accountants and, with respect to any other matter that may properly come before the Annual Meeting, at the discretion of the proxy holders.

May I change my vote after I return my proxy card or voting instruction card? You may revoke your proxy or change your vote at any time before it is exercised in one of three ways:

What does it mean if I receive more than one proxy or voting instruction card? It means that you have multiple accounts at the transfer agent and/or with banks and stockbrokers. Please vote all of your shares by returning all proxy and voting instruction cards you receive.

What constitutes a quorum? A quorum must be present to properly convene the Annual Meeting. The presence, in person or by proxy, of the holders of a majority of the outstanding shares entitled to vote at the Annual Meeting constitutes a quorum. You will be considered part of the quorum if you return a signed and dated proxy or voting instruction card or if you attend the Annual Meeting. Abstentions and broker non-votes are counted as shares present at the meeting for purposes of determining whether a quorum exists but not as shares cast for any proposal. Because abstentions and broker non-votes are not treated as shares cast, they would have no impact on Proposals 1 or 2.

What vote is required in order to approve each proposal? The required vote is as follows:

How will voting on any other business be conducted? We do not know of any business or proposals to be considered at the Annual Meeting other than those described in this Proxy Statement. If any other business is proposed and we decide to allow it to be presented at the Annual Meeting, the proxies received from our shareholders give the proxy holders the authority to vote on the matter according to their best judgment.

Who will count the votes? Investor Communications Services will tabulate the votes received prior to the Annual Meeting. Representatives of USANA will act as the inspectors of election and will tabulate the votes cast at the Annual Meeting.

Who pays to prepare, mail and solicit the proxies? We will pay all of the costs of soliciting proxies. We will ask banks, brokers and other nominees and fiduciaries to forward the proxy materials to the beneficial owners of our common stock and to obtain the authority of executed proxies. We will reimburse them for their reasonable expenses. In addition to the use of mail, proxies may be solicited by our officers, directors

4

and other employees by telephone or personal solicitation. We will not pay additional compensation to these individuals.

How do I submit a shareholder proposal for next year's Annual Meeting? Any shareholder who intends to present a proposal at the 2005 Annual Meeting of Shareholders must deliver the proposal to the Corporate Secretary, c/o USANA Health Sciences, Inc., 3838 West Parkway Blvd., Salt Lake City, Utah 84120, not later than December 16, 2004, if the proposal is submitted for inclusion in our proxy materials for that meeting pursuant to Rule 14a-8 under the Securities Exchange Act of 1934.

Who should I call if I have questions? If you have questions about the proposals or the Annual Meeting, you may call Riley Timmer, USANA Investor Relations, at (801) 954-7100. You may also send an e-mail to riley.timmer@us.usana.com.

PROPOSAL #1—ELECTION OF DIRECTORS

USANA's Bylaws provide that the shareholders or the Board of Directors shall determine the number of directors from time to time, but that there shall be no less than three. The Board of Directors currently has six members. The Board of Directors has determined that five directors will stand for re-election at the Annual Meeting. Each director elected at the Annual Meeting will hold office until the Annual Meeting in 2005, until a successor is elected and qualified, or until the director resigns, is removed or becomes disqualified. The Board of Directors has no reason to believe that any of the nominees for director will be unwilling or unable to serve if elected. If due to unforeseen circumstances a nominee should become unavailable for election, the Board may either reduce the number of directors or substitute another person for the nominee in which event your shares will be voted for that other person.

Marketplace Rule 4350 of The Nasdaq Stock Market ("Nasdaq") requires that the Board of Directors of the Company be comprised of a majority of independent directors. Prior to fiscal year 2004, the Company was exempt from compliance with this rule because a majority of the issued and outstanding shares of the Company's common stock was owned by a single shareholder; the Board of Directors was comprised of three independent directors and three associated directors. In order to comply with this rule, David Wentz, President of the Company, has agreed to step down from the Board of Directors. He will continue to serve as the Company's full-time President. At the meeting, the shareholders will vote to elect three independent directors (as defined in Marketplace Rule 4200(A)(15)) and two associated directors.

Director Nominees

The nominees to the Board of Directors in 2004 are Robert Anciaux, Jerry G. McClain, Ronald S. Poelman, Denis E. Waitley, Ph.D., and Myron W. Wentz, Ph.D. All of these nominees currently serve as members of the Board of Directors. Messrs. Anciaux, McClain, and Poelman are independent directors under the Nasdaq rules. The following information is furnished with respect to these nominees:

Robert Anciaux, 58, has served as a director of USANA since July 1996. Since 1990 he has been the Managing Director of S.E.I. s.a., a consulting and investment management firm in Brussels, Belgium. From 1982 to 1990, Mr. Anciaux was self-employed as a venture capitalist in Europe, investing in various commercial, industrial and real estate venture companies. In some of these privately held companies, Mr. Anciaux also serves as a director. Mr. Anciaux received an Ingenieur Commercial degree from Ecole de Commerce Solvay Universite Libre de Bruxelles.

Jerry G. McClain, 63, has served as a director of USANA since June 2001. From August 2000 until December 2002, Mr. McClain was the Chief Financial Officer of Cerberian, Inc., a privately held company headquartered in Salt Lake City, Utah. From 1998 to 2000, Mr. McClain was the Chief Financial Officer and Sr. Vice President of Assentive Solutions, Inc., a company he also co-founded.

5

From 1997 to 1998, Mr. McClain was the Chief Financial Officer for the Salt Lake Organizing Committee for the 2002 Winter Olympic Games. Before 1997, Mr. McClain served as a key financial advisor to many companies as a Senior Partner of Ernst & Young LLP, where for 35 years he served in several cities throughout the world. Mr. McClain is a CPA and a graduate from the University of Southern Mississippi and Oklahoma State University where he received a B.S. in accounting and an M.S. in accounting respectively.

Ronald S. Poelman, 50, has served as a director of USANA since 1995. Since 1994, he has been a partner in the Salt Lake City, Utah law firm of Jones, Waldo, Holbrook & McDonough, where he is head of the Corporate Finance Group. Mr. Poelman began his legal career in Silicon Valley in California, and has assisted in the organization and financing of numerous companies over the past 20 years. Mr. Poelman received a B.A. in English from Brigham Young University and a J.D. from the University of California, Berkeley.

Denis E. Waitley, Ph.D., 70, has served as a director of USANA since May 2000. Dr. Waitley has also served as a consultant to and a spokesperson for USANA since September 1996. Since 1980, Dr. Waitley has been President of the Waitley Institute, a corporate leadership-training firm he founded to provide professional and personal development skills for business executives. Dr. Waitley also serves as President of International Learning Technologies, Inc., a company he founded in 1989 that produces educational audio/visual materials for companies and individuals. During the 1980's, Dr. Waitley served as Chairman of Psychology for the U.S. Olympic Committee's Sports Medicine Council, responsible for the performance enhancement of all American Olympic athletes. He is the author of several national best selling non-fiction books and audio programs on personal excellence. Dr. Waitley received a B.S. from the U.S. Naval Academy at Annapolis, an M.A. in Organizational Development from the Naval Post Graduate School in Monterrey, California and a Ph.D. in Human Behavior from La Jolla University.

Myron W. Wentz, Ph.D., 63, founded USANA in 1992 and has served as the Chief Executive Officer and Chairman of the Board of USANA since its inception. In 1974, Dr. Wentz founded Gull Laboratories, Inc., a developer and manufacturer of medical diagnostic test kits and the former parent of USANA. Dr. Wentz served as Chairman of Gull from 1974 until 1998. In 1998, Dr. Wentz founded Sanoviv, S.A. de C.V. ("Sanoviv"), a health and wellness center located near Rosarito, Mexico. From 1969 to 1973, Dr. Wentz served as Director of Microbiology for Methodist Medical Center, Proctor Community Hospital, and Pekin Memorial Hospital, all of which are located in Peoria, Illinois. Dr. Wentz received a B.S. in Biology from North Central College, Naperville, Illinois, a M.S. in Microbiology from the University of North Dakota, and a Ph.D. in Microbiology with an emphasis in Immunology from the University of Utah.

We will vote your shares as you specify in your proxy. If you sign, date and return your proxy but do not specify how you want your shares voted, we will vote them FOR the election of each of the nominees listed above.

RECOMMENDATION

The Board of Directors unanimously recommends a vote FOR each director nominee.

PROPOSAL #2—RATIFICATION OF SELECTION OF INDEPENDENT PUBLIC ACCOUNTANTS

The Audit Committee of the Board of Directors has selected Grant Thornton LLP as the independent public accountants to audit the financial statements of the Company and its subsidiaries for the fiscal year ending January 1, 2005. Grant Thornton has served as the Company's independent public accountants since the fiscal year ended December 31, 1995 and audited the financial statements of the Company for the years ended December 28, 2002 and January 3, 2004. While ratification of the

6

selection of accountants by the shareholders is not required and is not binding upon the Audit Committee or the Company, in the event of a negative vote on such ratification, the Audit Committee might choose to reconsider its selection.

Grant Thornton has advised us that it has no direct or indirect financial interest in the Company or any of its subsidiaries, and that it has had, during the last three years, no connection with the Company or any of its subsidiaries other than as independent auditors and certain other activities as described below.

Financial Statements and Reports

The financial statements of the Company for the year ended January 3, 2004, and report of the auditors will be presented at the Annual Meeting. Grant Thornton will have a representative present at the meeting who will have an opportunity to make a statement if he or she so desires and to respond to appropriate questions from shareholders.

During fiscal years 2002 and 2003, Grant Thornton provided services consisting of the audit of the annual consolidated financial statements of the Company, review of the quarterly financial statements, stand-alone audits of subsidiaries, accounting consultations and consents and other services related to SEC filings and registration statements filed by the Company and its subsidiaries and other pertinent matters. Grant Thornton also provided other services to the Company in 2003 consisting primarily of tax consultation and related services. Grant Thornton did not perform any financial information systems design and implementation services for the Company for the two fiscal years ended December 28, 2002 and January 3, 2004.

The Audit Committee has considered whether the provision of non-audit services is compatible with maintaining Grant Thornton's independence. Prior to the performance of any services, the Audit Committee approves all audit and non-audit related services to be provided by the Company's independent auditor and the fees to be paid therefore. Although the Sarbanes-Oxley Act of 2002 permits the Audit Committee to pre-approve some types or categories of services to be provided by the auditors, it is the current practice of the Audit Committee to specifically approve all services provided by the auditors in advance, rather than to pre-approve, generally, any type of service. The increase in total fees for fiscal year 2003 was primarily the result of the Company's expansion into new foreign markets and the new corporate governance regulations adopted pursuant to Sarbanes-Oxley and related rule-making by the Nasdaq Stock Market and the Securities and Exchange Commission.

The following table summarizes the fees paid to Grant Thornton during fiscal years 2002 and 2003.

| Type of Service and Fee |

Fiscal 2003 |

Fiscal 2002 |

||||

|---|---|---|---|---|---|---|

| Audit Fees | $ | 179,244 | $ | 125,875 | ||

| Audit Related Fees | 25,421 | 7,146 | ||||

| Tax Fees | 153,376 | 79,450 | ||||

| All Other Fees | — | 35,904 | ||||

| Total Fees | $ | 358,041 | $ | 248,375 | ||

RECOMMENDATION

The Board of Directors unanimously recommends a vote FOR the appointment of Grant Thornton LLP as the Company's independent public accountants.

7

The Board of Directors is elected by and accountable to the shareholders of the Company. The Board establishes policy and provides strategic direction, oversight and control of the Company. The Board meets at least four times each year and in special meetings when necessary. In 2003, all directors attended at least 75% of the meetings of the Board and the Board Committees of which they are members.

We assess director independence on an annual basis. The Board has determined, after careful review, that each member of the Audit Committee is independent, and that three of the five members of the Board of Directors nominated for election are independent under applicable listing standards of Nasdaq.

Shareholder Communications with Directors

The Board of Directors has not established a formal process for shareholders to follow to send communications to the Board or its members, as the Company's policy has been to forward to the directors any shareholder correspondence it receives that is addressed to them. Shareholders who wish to communicate with the directors may do so by sending their correspondence addressed to the director or directors at the Company's headquarters at 3838 West Parkway Blvd., Salt Lake City, Utah 84120-6336.

Directors are encouraged by the Company to attend the Annual Meeting of Shareholders if their schedules permit. All directors except Robert Anciaux were present at the Annual Meeting of the Shareholders held in May 2003.

Committees of the Board of Directors

The Board of Directors has a standing Audit Committee, Compensation Committee, Executive Committee, and Nominating Committee. All members of the Audit Committee, Compensation Committee and the Nominating Committee are "independent" as that term is defined by applicable Nasdaq Marketplace Rules.

The Board appointed the Nominating Committee pursuant to corporate governance rules recently adopted by The Nasdaq Stock Market. The current members of this Committee are Messrs. Anciaux and Poelman, both of whom are independent directors under Nasdaq rules. The Board will adopt a written charter for this committee following the Annual Meeting. Until the Nominating Committee begins functioning under a written charter, the Board has determined that such functions can adequately be performed by the entire Board. In so functioning as the nominating committee, the responsibilities of the Board include identifying and evaluating prospective nominees for director and periodically reviewing the performance of the Board and its members and determining the number, function and composition of the Board's committees.

The Board believes that it should be comprised of directors with varied, complementary backgrounds, and that directors should, at a minimum, have expertise that may be useful to the Company. Directors should also possess the highest personal and professional ethics and should be willing and able to devote the required amount of time to Company business. In determining whether a director should be retained and stand for re-election, the Board also considers that member's performance and contribution to the Board during his or her tenure with the Board.

Audit Committee. The Audit Committee met four times during fiscal year 2003. Members of the Audit Committee during fiscal year 2003 and at the date of this Proxy Statement are Ronald S. Poelman, Chairman, Robert Anciaux and Jerry G. McClain. The Board has determined that

8

Mr. McClain is an "audit committee financial expert", as defined by Item 401 under Regulation S-K promulgated by the Securities and Exchange Commission. The Board of Directors has adopted a written charter for the Audit Committee. We believe that the charter complies with the current requirements of Nasdaq regarding audit committee charters. The Audit Committee appoints the independent public accountants of the Company and reviews and approves the scope and cost of proposed audit and non-audit services provided by, as well as the qualifications and independence of the independent auditors. The Audit Committee reviews with the independent auditors and internal audit staff the results of audits, any recommendations from and the status of management's actions for implementing such recommendations, as well as the quality and adequacy of our internal financial controls and internal audit staff. It also reviews our annual and quarterly financial statements and the status of material pending litigation and regulatory proceedings.

Compensation Committee. The Compensation Committee met four times during fiscal year 2003. The members of the Compensation Committee during fiscal year 2003 and at the date of this Proxy Statement are Robert Anciaux, Chairman, Jerry G. McClain and Ronald S. Poelman. The Compensation Committee is responsible for and reviews and recommends to the full Board of Directors the salaries, bonuses and other forms of compensation and benefit plans for management and administers USANA's stock option plans. Among other things, the duties of the Compensation Committee as the administrator of the plan include, but are not limited to, determining those persons who are eligible to receive awards, establishing terms of all awards, authorizing officers of the Company to execute grants of awards, and interpreting the provisions of the Plan and grants made under the Plan.

Executive Committee. Subject to certain restrictions, the Executive Committee possesses and exercises the powers of the Board of Directors during the intervals between regular meetings of the Board. During fiscal year 2003, the members of the Executive Committee were Dr. Myron Wentz, Chairman, Ronald S. Poelman and David A. Wentz.

Each director who is not an employee of the Company receives an annual retainer of $5,000. We also reimburse all directors for their out-of-pocket expenses incurred in connection with their services as directors, which include travel, lodging and related expenses from attending or participating in meetings of the shareholders, Board of Directors and committees of the Board.

In June 1998, the Board of Directors adopted and the stockholders approved the combination of the Directors' Plan with USANA's Incentive and Stock Option Plan into the Amended and Restated Stock Incentive and Option Plan ("1998 Stock Option Plan"). New directors elected commencing in June 1998 received options granted under that combined plan as determined by the Executive Committee, which then administered the plan.

In July 2002, the Board of Directors adopted and the stockholders approved the 2002 Stock Option Plan. Each director was granted options based upon their respective time spent serving on the Board. With the adoption of the 2002 Stock Option Plan, the Board determined that no new awards would be granted under the prior plans. In addition, certain director options were cancelled during 2002 with the adoption of the 2002 Stock Option Plan. The Compensation Committee of the Board of Directors now administers the stock option plans of the Company.

Our Bylaws provide that individuals serving as directors or officers of the Company will not incur personal liability for actions taken during their service and that the Company will indemnify its directors and officers to the fullest extent authorized by Utah law. The Company has purchased insurance against obligations it might incur as a result of its indemnification of officers and directors for certain liabilities they might incur, and insuring such officers and directors for additional liabilities against which they might not be indemnified by USANA. The policy also provides insurance for our

9

own liabilities in certain circumstances. The cost of the insurance premiums covering the 12-month period ending November 20, 2004 is approximately $563,000.

[The following report of the Audit Committee shall not be deemed incorporated by reference by any general statement incorporating this Proxy Statement into any other filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent USANA specifically incorporates this information by reference, and shall not otherwise be deemed filed under those acts.]

The Audit Committee oversees the Company's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. The directors who serve on the Audit Committee are all independent for purposes of the Rule 4200(A)(15) of The National Association of Securities Dealers' listing standards and The Nasdaq Marketplace Rules.

The Audit Committee operates under a written charter adopted by the Board of Directors.

We have reviewed and discussed with management the Company's audited financial statements as of and for the year ended January 3, 2004.

We have discussed with the independent public accountants of the Company, Grant Thornton LLP, the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended, by the Auditing Standards Board of the American Institute of Certified Public Accountants, which includes a review of the findings of the independent accountants during its examination of the Company's financial statements.

We have received and reviewed written disclosures and the letter from Grant Thornton, required by Independence Standard No. 1, Independence Discussions with Audit Committee, as amended, by the Independence Standards Board, and we have discussed with Grant Thornton their independence under such standards. We have concluded that the independent public accountants are independent from the Company and its management.

Based on our review and discussions referred to above, we have recommended to the Board of Directors (and the Board has approved our recommendation) that the audited financial statements of the Company be included in the Company's Annual Report on Form 10-K for the year ended January 3, 2004 for filing with the Securities and Exchange Commission.

Respectfully submitted to the Board of Directors on March 12, 2004,

Audit Committee |

||

Ronald S. Poelman (Chairman) Robert Anciaux Jerry G. McClain |

10

The executive officers of USANA at January 3, 2004 were:

| Name |

Position |

|

|---|---|---|

| Myron W. Wentz, Ph.D. | Chairman of the Board and Chief Executive Officer | |

David A. Wentz |

President and Director |

|

Gilbert A. Fuller |

Senior Vice President and Chief Financial Officer |

|

Fred W. Cooper, Ph.D. |

Vice President of Operations |

|

Mark H. Wilson |

Vice President of Customer Relations |

|

Timothy E. Wood, Ph.D. |

Vice President of Research and Development |

Biographical information for Myron W. Wentz is included in the discussion on page 6 concerning the nominees for director. The following information is provided regarding David Wentz and Messrs. Fuller, Cooper, Wilson and Wood.

David A. Wentz, 33, President. Mr. Wentz joined USANA as a part-time employee in 1992. He has been a full-time employee since March 1994. From 1993 until April 2004 he was a member of the Company's Board of Directors. Mr. Wentz was appointed President of USANA in July 2002, previously serving as Executive Vice President from October 2001 to July 2002. He served as the Senior Vice President of Strategic Development from June 1999 to October 2001 and as the Vice President of Strategic Development from August 1996 to June 1999. Mr. Wentz received a B.S. degree in Bioengineering from the University of California, San Diego. Mr. Wentz is the son of Dr. Wentz, the Chairman and Chief Executive Officer of the Company.

Gilbert A. Fuller, 63, Senior Vice President and Chief Financial Officer. Mr. Fuller joined USANA in May 1996 as the Vice President of Finance. Mr. Fuller served in this role from May 1996 to June 1999, when he was appointed Senior Vice President. Mr. Fuller has been Chief Financial Officer since October 1997. Before joining USANA, from January 1994 to May 1996, Mr. Fuller was the Executive Vice President of Winder Dairy, Inc., a regional commercial dairy operation. From May 1991 through October 1993, Mr. Fuller was Chief Administrative Officer and Treasurer of Melaleuca, Inc., a manufacturer and network marketer of personal care products. From July 1984 through January 1991, Mr. Fuller was the Vice President and Treasurer of Norton Company, a multinational manufacturer of ceramics and abrasives. Mr. Fuller is a Certified Public Accountant and received a B.S. in Accounting and an M.B.A. from the University of Utah.

Fred W. Cooper, Ph.D., 41, Vice President of Operations. Dr. Cooper was a consultant to the Company from 1997 until early 1998. In February of 1998 he joined the Company on a part-time basis as Director of Special Projects. From April 1998 until April 1999 he was employed as a full-time employee in the capacity of Executive Director of Information Technology and from April 1999 until August 2000, with the title of Vice President of Information Technology. From August 2000 until July 1, 2003, Dr. Cooper was employed by the Company on a part-time basis as Vice President of Information Technology. He was again brought on as a full time employee in July 2003 as Vice President of Operations, with that appointment being approved by the Board of Directors in October 2003. Prior to joining USANA, Dr. Cooper was the Director of Market Research and then later promoted to Director of Corporate Network Operations for Human Affairs International, a subsidiary of Aetna, from April 1994 to February 1998. Dr. Cooper received a B.S. in Finance and Psychology from the University of Utah. He earned a Ph.D. in Business Administration from the University of Utah.

Mark H. Wilson, 39, Vice President of Customer Relations. Mr. Wilson joined USANA in October of 1996 as Director of Customer Relations. Mr. Wilson served as Executive Director of

11

Customer Relations from 1998 to April 2000. Since April 2000, he has served as the Vice President of Customer Relations. Prior to joining USANA, from October 1994 to October 1996, Mr. Wilson was owner/partner of Great Basin Marketing, a consulting company specializing in call center start-up and operational management. Prior to joining Great Basin Marketing, Mr. Wilson was Director of Inbound Order Express and Data Processing for Melaleuca, Inc., from July 1991 until October 1994. Mr. Wilson holds a bachelor's degree in communications from the University of Utah.

Timothy E. Wood, Ph.D., 55, Vice President of Research and Development. Dr. Wood joined USANA in June 1996 as Director of Research and Development. Dr. Wood served in this role from June 1996 to June 1999, when he was appointed Vice President of Research and Development. Before joining USANA, Dr. Wood served as Vice President of Research and Development for AgriDyne Technologies, Inc., formerly known as NPI, from 1992 to 1995, where he managed a team of 25 scientists. From 1980 to 1992, Dr. Wood served as Research Manager and Senior Scientist for AgriDyne Technologies. Dr. Wood received a B.S. in environmental biology from the University of California, Santa Barbara. He earned an M.S. in environmental sciences and a Ph.D. in biology from Yale University.

12

The following table sets forth certain information regarding the beneficial ownership of our common stock as of February 27, 2004 by (1) each person known to be the beneficial owner of more than 5% of the issued and outstanding common stock, (2) the executive officers and directors of USANA individually, and (3) the executive officers and directors as a group. Except as indicated in the footnotes below, each of the persons listed is believed to exercise sole voting and investment power over the shares of common stock listed for such individual or entity in the table. Unless otherwise indicated, the mailing address of the shareholder is the address of USANA, 3838 West Parkway Blvd., Salt Lake City, Utah 84120.

| Name and Address |

Number of Shares(1) |

Percent of Class(2) |

||||

|---|---|---|---|---|---|---|

| Beneficial Owners of More Than 5% | ||||||

Gull Holdings, Ltd. 4 Finch Road Douglas, Isle of Man |

8,212,964 |

42.6 |

% |

|||

Goldman, Sachs & Co. 10 Hanover Square New York, NY 10005 |

1,057,299 |

5.5 |

% |

|||

Directors and Executive Officers |

||||||

Myron W. Wentz, Ph.D.(3) Chairman of the Board and CEO |

8,212,964 |

42.6 |

% |

|||

David A. Wentz, President(4) |

354,653 |

1.8 |

% |

|||

Gilbert A. Fuller(5) Senior Vice President and CFO |

11,649 |

* |

||||

Fred W. Cooper, Ph.D.(6) Vice President of Operations |

21,315 |

* |

||||

Mark H. Wilson(7) Vice President of Customer Relations |

10,865 |

* |

||||

Timothy E. Wood, Ph.D.(8) Vice President of Research and Development |

15,000 |

* |

||||

Robert Anciaux, Director |

— |

* |

||||

Jerry G. McClain, Director(9) |

200 |

* |

||||

Ronald S. Poelman, Director(10) |

20,000 |

* |

||||

Denis E. Waitley, Ph.D., Director(11) |

93,654 |

* |

||||

Directors and Officers as a group (10 persons) |

8,740,300 |

45.3 |

% |

|||

13

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

[The following report of the Compensation Committee shall not be deemed incorporated by reference by any general statement incorporating this Proxy Statement into any other filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent USANA specifically incorporates this information by reference, and shall not otherwise be deemed filed under those acts.]

The Compensation Committee of the Board of Directors (the "Compensation Committee") administers the Company's executive compensation program and establishes the salaries of the Company's executive officers. The Compensation Committee consists only of non-employee directors, who are appointed by the Board.

Compensation Policy

The primary responsibility of the Compensation Committee is to establish executive compensation at levels that will achieve the following objectives:

14

The components of compensation paid to executive officers consist of: (a) base salary, (b) incentive compensation in the form of stock options awarded under the 1998 and 2002 Stock Option Plans and (c) certain other benefits. In 1998, the Committee adopted a cash bonus program as an additional component of executive compensation. A similar bonus program was adopted in each subsequent fiscal year. Fiscal year 2002 was the first year since 1998 that a bonus was earned. A bonus was also earned in fiscal year 2003 under this bonus program.

Components of Compensation

The primary components of compensation paid to executive officers and senior management personnel, and the relationship of these components of compensation to the Company's performance, are discussed below:

Compensation of the Chief Executive Officer

The Company's Founder and Chairman Myron W. Wentz, has also served with the title of Chief Executive Officer of USANA since its inception. Dr. Wentz does not receive any compensation for his services and he has in the past declined to accept any options or other awards under any stock option or stock incentive plan that he might otherwise have been entitled to receive as an executive officer.

Internal Revenue Code Section 162(m)

The Compensation Committee also considers the potential impact of Section 162(m) of the Internal Revenue Code of 1986, as amended ("Section 162(m)"). Section 162(m) disallows a tax deduction for any publicly held corporation for individual compensation exceeding $1 million in any

15

taxable year for the Chief Executive Officer and the other senior executive officers, other than compensation that is performance-based under a plan that is approved by the shareholders of the corporation and that meets certain other technical requirements. Based on these requirements, the Compensation Committee has determined that Section 162(m) will not prevent the Company from receiving a tax deduction for any of the compensation paid to executive officers.

Submitted on March 12, 2004 by the members of the Compensation Committee:

| Robert Anciaux (Chairman) Jerry G. McClain Ronald S. Poelman |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee as of January 3, 2004, was comprised of Robert Anciaux, Chairman, Jerry G. McClain and Ronald S. Poelman. All members of the Compensation Committee are independent directors.

COMPENSATION OF EXECUTIVE OFFICERS

The following table sets forth the annual and long-term compensation for services rendered in all capacities to the Company for the last three fiscal years of (1) the Chief Executive Officer and (2) the four most highly compensated executive officers of the Company as of the end of the most recent fiscal year whose total annual salary and bonus exceeds $100,000 ("Named Executive Officers").

| |

|

Annual Compensation |

Long-Term Compensation Securities Underlying Options(2) |

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Position During 2003 |

Year |

Salary |

Bonus |

Other Annual Compensation(1) |

All Other Compensation(3) |

|||||||||||

| Myron W. Wentz, PhD(4) Chairman and CEO |

2001 2002 2003 |

— — — |

— — — |

— — — |

0 0 0 |

— — — |

||||||||||

| David A. Wentz President |

2001 2002 2003 |

$ $ $ |

103,982 144,498 149,168 |

$ $ |

— 69,114 29,567 |

(5) (6) |

$ |

— — 602,150 |

0 300,000 0 |

$ $ $ |

7,089 7,885 2,420 |

|||||

| Gilbert A. Fuller Senior Vice President and Chief Financial Officer |

2001 2002 2003 |

$ $ $ |

159,355 167,860 168,318 |

$ $ |

— 80,036 33,793 |

(5) (6) |

$ $ |

— 555,600 1,237,050 |

0 340,000 0 |

$ $ $ |

7,720 6,725 7,000 |

|||||

| Mark H. Wilson Vice President of Customer Relations |

2001 2002 2003 |

$ $ $ |

99,814 118,150 128,391 |

$ $ |

— 56,960 25,597 |

(5) (6) |

$ $ |

— 408,100 1,308,154 |

0 300,000 0 |

$ $ $ |

1,140 3,608 5,065 |

|||||

| Timothy E. Wood Vice President of Research and Development |

2001 2002 2003 |

$ $ $ |

107,966 118,679 129,073 |

$ $ |

— 56,751 25,724 |

(5) (6) |

$ $ |

— 279,975 1,185,157 |

0 310,000 0 |

$ $ $ |

953 3,344 4,001 |

|||||

16

360,000 shares of common stock at an exercise price of $2.42 per share with the consent of the option holder.

OPTION GRANTS IN LAST FISCAL YEAR

There were no option grants to the Named Executive Officers during the fiscal year ended January 3, 2004.

OPTION EXERCISES AND FISCAL YEAR-END OPTION VALUE

The following table sets forth information with respect to the exercise of stock options by the Named Executive Officers during the year ended January 3, 2004, as well as the aggregate number and value of unexercised options held by all Named Executive Officers at January 3, 2004. In accordance with Securities and Exchange Commission rules, the value of unexercised options is calculated by subtracting the exercise price from $29.79, the closing price of the common stock as reported on The Nasdaq National Market System on January 2, 2004.

Aggregated Option Exercises in Last Fiscal Year

And Fiscal Year-End Option Values

| Name |

Shares Acquired on Exercise |

Value Realized |

Number of Securities Underlying Unexercised Options at 1/3/2004 Exercisable/ Unexercisable |

Value of Unexercised In- the-Money Options at 1/3/2004 Exercisable/ Unexercisable |

||||||

|---|---|---|---|---|---|---|---|---|---|---|

| David A. Wentz | 120,000 | $ | 1,292,650 | 160,000 / 170,000 | $ | 4,595,300 / $4,905,150 | ||||

| Gilbert A. Fuller | 50,000 | $ | 1,237,050 | 0 / 180,000 | $ | 0 / $5,181,300 | ||||

| Mark H. Wilson | 50,000 | $ | 1,308,185 | 0 / 180,000 | $ | 0 / $5,181,300 | ||||

| Timothy E. Wood, Ph.D. | 90,000 | $ | 1,322,707 | 5,000 / 180,000 | $ | 144,825 / $5,181,300 | ||||

EMPLOYMENT CONTRACTS AND OTHER ARRANGEMENTS

The Company has no employment agreements with any of the Named Executive Officers.

On October 14, 2003, the Company declared a two-for-one stock split of its common stock that was distributed in the form of a stock dividend on October 30, 2003 to shareholders of record as of October 24, 2003. All existing stock option agreements provide that the number of shares of common stock and the respective exercise price covered by each outstanding option agreement be proportionately adjusted for a stock split or similar event. Stock option data (including the number of shares subject to issuance upon exercise of options and the option exercise price) set forth below have been adjusted to reflect the forward stock split.

The Company maintains the 1998 Stock Option Plan approved by shareholders under which options and other nonstatutory awards were granted to employees, officers, directors and consultants of the Company. The Compensation Committee of the Board of Directors now administers the plan. The

17

total number of shares of common stock reserved for issuance under the 1998 plan was 8,000,000 shares. As of January 3, 2004, options for the purchase of 449,000 shares remained issuable upon outstanding options under the 1998 Stock Option Plan. With the adoption of the 2002 Stock Option Plan, the Board of Directors determined that no further awards would be granted under the 1998 Stock Option Plan.

In 2002, the Company adopted and the shareholders approved the 2002 USANA Health Sciences, Inc. Stock Plan ("2002 Plan"), under which nonstatutory and statutory awards have been granted to employees, officers and directors. The total number of shares of common stock that may be issued upon exercise of awards granted under the 2002 Plan is 7,000,000 shares. As of January 3, 2004, a total of 3,474,000 shares were available for issuance under options to be granted under the 2002 Plan and 2,016,000 shares were issuable upon outstanding options granted previously under the 2002 Plan.

The following table sets forth information as of January 3, 2004, with respect to shares of common stock to be issued upon the exercise, and the weighted-average exercise price, of all outstanding options and rights granted under our equity compensation plans, as well as the number of shares available for future issuance under those plans.

Equity Compensation Plans In Effect

| Plan Category(1) |

Number of Securities to be Issued upon Exercise of Outstanding Options, Warrants and Rights |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights |

Number of Securities Remaining Future Issuance Available for Under Equity Compensation Plans |

||||

|---|---|---|---|---|---|---|---|

| 2002 Stock Option Plan | 2,016,000 | $ | 2.20 | 3,474,000 | |||

| 1998 Stock Option Plan | 449,000 | $ | 2.37 | 0 | |||

| Total | 2,465,000 | $ | 2.34 | 3,474,000 | |||

COMPLIANCE WITH SECTION 16(a) OF THE EXCHANGE ACT

Section 16(a) of the Securities Exchange Act of 1934 requires USANA's officers and directors, and persons who beneficially own more than 10% of our common stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission and with Nasdaq. Officers, directors and greater-than-ten-percent shareholders are also required by regulation of the Securities and Exchange Commission to furnish us with copies of all Section 16(a) forms that they file.

Based solely upon a review of the forms furnished to the Company, and representations made by certain persons subject to this obligation that such filing were not required to be made, except as set forth below the Company believes that all but one report required by these individuals and persons under Section 16(a) were filed on time in fiscal year 2003. Dr. Wentz filed a Form 4 one day after its due date showing an open market sale of 100,000 shares by Gull Holdings Ltd.

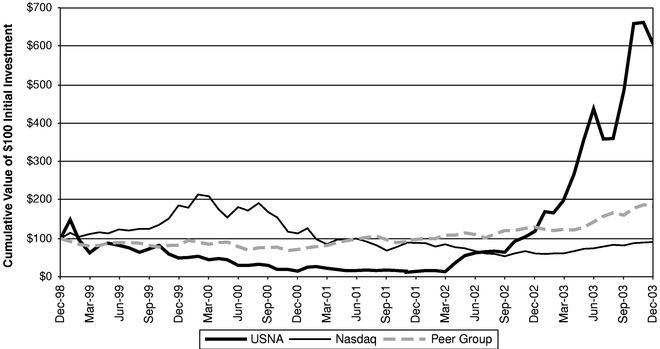

The following graph compares the yearly cumulative total returns on our common stock, the Total Return Index for the Nasdaq Stock Market, and ten companies selected in good faith by USANA from its industry (the "Peer Group") for the last five years. Each of the companies included in the Peer Group markets or manufactures products similar to USANA's products or markets its products through a similar marketing channel. Each company listed was included in the Peer Group in each of the last five years except Nuskin, which was added to the Peer Group for the first time in the Company's 2002 proxy statement. The Peer Group comprises the following companies: NBTY, Inc. (NYSE: NTY),

18

Nature's Sunshine Products, Inc. (Nasdaq: NATR), Avon Products, Inc. (NYSE: AVP), NuSkin Enterprises, Inc. (NYSE: NUS), Natural Alternatives International, Inc. (Nasdaq: NAII), Perrigo Company (Nasdaq: PRGO), Reliv International, Inc. (Nasdaq: RELV), Hain Celestial Group (Nasdaq: HAIN), Lifeway Foods, Inc. (Nasdaq: LWAY) and Chattem, Inc. (Nasdaq: CHTT).

USANA's shares commenced trading in May 1993. The graph assumes an investment on December 30, 1998, of $100 and reinvestment of all dividends into additional shares of the same class of equity, if applicable to the stock or index. This graph is included in accordance with SEC requirements. You are cautioned not to draw any conclusions from this information, as past results are not necessarily indicative of future performance. This graph in no way reflects a forecast of future financial performance or value.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

USANA's Chairman and CEO, Myron W. Wentz, is the sole beneficial owner of the single largest shareholder of USANA, Gull Holdings, Ltd. Dr. Wentz is also the founder and sole administrator of Sanoviv, a health and wellness center located near Rosarito, Mexico, owned in equal shares by Dr. Wentz and his son, David, the Company's President. During the year ended January 3, 2004, the Company advanced expenses and provided certain services to Sanoviv totaling approximately $111,000. Dr. Wentz deposited funds on account with the Company as prepayment of these expenses which are invoiced to Sanoviv and reimbursed from the deposited funds. As of January 3, 2004, there were no outstanding amounts due to USANA from Sanoviv or Dr. Wentz. The Company has no commitment or obligation to continue to provide additional funding or support to Sanoviv.

Denis E. Waitley, Ph.D., a director of the Company, has served as a consultant to and spokesperson for the Company since September 1996. During 2003, the Company paid Dr. Waitley consulting fees and royalties totaling $153,000. The consulting contract with Dr. Waitley pays him $150,000 per year and expires in September 2005.

The Audit Committee of the Board of Directors has reviewed and approved all of the transactions described above.

19

Fred Cooper served in non-executive full and part-time positions and was a consultant to the Company on various special projects during the period from late 1997 until the time of his promotion as an executive officer in 2003. The promotion of Dr. Cooper to the position of Vice President of Operations in July 2003 was approved by the Board of Directors in October 2003 as part of a plan to restructure and streamline the reporting and management responsibilities of executive management at the Company. With this promotion, Dr. Cooper is now considered by the Board to be an "executive officer" for purposes of Section 16 of the Securities Exchange Act of 1934.

Until December 27, 2003, Dr. Cooper owned and controlled iCentris, an entity engaged in the business of designing and servicing specialized computer programs and software for network marketing companies. In the fourth quarter of 2001, the Company implemented an iCentris-designed and installed order-entry system known as Odyssey. Additional enhancements and improvements were added to Odyssey during fiscal years 2002 and 2003.

During 2003, iCentris provided support for the Odyssey system as installed, including all enhancements and additional modules added since the original installation in 2001. In addition, iCentris provided web hosting and Internet-based downline management services for USANA Associates who contract for such services through the Company. Payments to iCentris for all such services provided during fiscal year 2003 totaled $1.079 million as follows: (1) system development, $261,000; (2) support and maintenance, $416,000; and (3) online business services, $402,000.

The Company believes that the amounts paid to iCentris are fair and do not exceed what it would have been required to pay to an unrelated party for the same services or products pursuant to bids obtained prior to awarding the contract to iCentris. Some of the development, support and maintenance services, and the agreement related to the sale of online business services to Associates are renewable annually.

At the request of the Company, Dr. Cooper divested himself of all ownership and involvement with iCentris in December 2003 following his appointment and promotion to Vice President of Operations. David Wentz, the Company's President and a member of the Board of Directors during fiscal years 2000 through 2003 was a director of iCentris until November 2003 representing the interests of USANA, but at no time did Mr. Wentz have any beneficial ownership or pecuniary interest in iCentris.

As of the date of this Proxy Statement, the Board of Directors does not intend to present and has not been informed that any other person intends to present any matter for action at the Annual Meeting other than as set forth herein and in the Notice of Annual Meeting. If any other matter properly comes before the meeting, it is intended that the holders of proxies will act in accordance with their best judgment.

The accompanying proxy is solicited on behalf of the Board of Directors. In addition to the solicitation of proxies by mail, certain of the officers and employees of the Company, without extra compensation, may solicit proxies personally or by telephone, and, if deemed necessary, third party solicitation agents may be engaged by the Company to solicit proxies by means of telephone, facsimile or telegram, although no such third party has been engaged by the Company as of the date hereof.

We will mail a copy of the Company's Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, to each shareholder of record at March 12, 2004. The report on Form 10-K is not deemed a part of the proxy soliciting material.

20

Additional copies of the Annual Report on Form 10-K for the year ended January 3, 2004 (including financial statements and financial statements schedules) filed with the Securities and Exchange Commission may be obtained without charge by writing to USANA, Attention: Investor Relations, 3838 West Parkway Blvd., Salt Lake City, Utah 84120-6336. The reports and other filings of USANA, including this Proxy Statement, also may be obtained from the SEC's on-line database, located at www.sec.gov.

| By Order of the Board of Directors | ||

/s/ GILBERT A. FULLER Gilbert A. Fuller Corporate Secretary |

Date: March 19, 2004

21

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The shareholder executing and delivering this Proxy as directed above appoints Myron W. Wentz, Ph.D. and Gilbert A. Fuller and each of them as Proxies, with full power of substitution, and hereby authorizes them to represent and vote, as designated below, all shares of common stock of the Company held of record by the undersigned as of March 12, 2004, at the Annual Meeting of Shareholders of USANA Health Sciences, Inc., to be held at the Corporate headquarters, 3838 West Parkway Blvd., Salt Lake City, Utah 84120, on Wednesday, April 21, 2004, at 11:00 a.m., Mountain Daylight Time or at any adjournment thereof.

The Board of Directors recommends a Vote "FOR" Items 1 and 2.

| Myron W. Wentz, Ph.D. | Ronald S. Poelman | |||

| Robert Anciaux | Denis E. Waitley, Ph.D. | Jerry G. McClain |

| FOR ALL | WITHHOLD AS TO ALL | FOR ALL EXCEPT | ||

| o | o | o |

| FOR | AGAINST | ABSTAIN | ||

| o | o | o |

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR PROPOSALS 1 AND 2.

PLEASE SIGN EXACTLY AS THE SHARES ARE ISSUED. WHEN CO-TENANTS HOLD SHARES, BOTH SHOULD SIGN. WHEN SIGNING AS ATTORNEY, AS EXECUTOR, ADMINISTRATOR, TRUSTEE OR GUARDIAN, PLEASE GIVE FULL TITLE AS SUCH. IF A CORPORATION, PLEASE SIGN IN FULL CORPORATE NAME BY PRESIDENT OR OTHER AUTHORIZED OFFICER. IF A PARTNERSHIP, PLEASE SIGN IN PARTNERSHIP NAME BY AUTHORIZED PERSON. PLEASE DATE, SIGN AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

DATE: |

Signature |

|||

Signature (Joint Owners) |